Is China preparing to return its stranded astronauts in its damaged Shenzhou capsule?

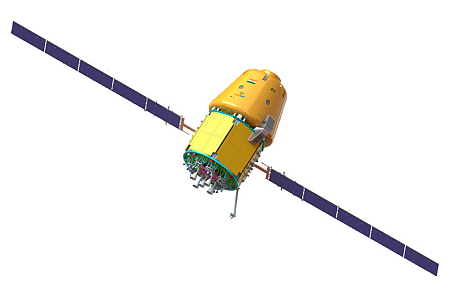

According to reports from China, it appears they are preparing to return the three-person Shenzhou-20 crew on their damaged Shenzhou-20 capsule on November 14, 2025, rather than launch a replacement capsule as had been rumored previously.

China has issued a temporary airspace restriction over Inner Mongolia for 3:20 to 3:50 a.m. Eastern (0820-0850 UTC, or 4:20-4:50 p.m. Beijing time) Nov. 14, according to a Notice to Airmen (NOTAM) published by the Hohhot Flight Information Region under the Civil Aviation Administration of China (CAAC).

The airspace closure notice matches an area covering the Dongfeng landing site, an area in Inner Mongolia roughly 60 to 90 kilometers to the east-southeast of the Jiuquan Satellite Launch Center, which has been used for all Shenzhou crewed spacecraft returns since 2021.

None of this is confirmed as yet, as China’s state-run press continues to be very secretive about this entire affair. It as yet not released any details about the damage to Shenzhou-20, nor has it been forthcoming with any details about the next steps it plans to take.

According to reports from China, it appears they are preparing to return the three-person Shenzhou-20 crew on their damaged Shenzhou-20 capsule on November 14, 2025, rather than launch a replacement capsule as had been rumored previously.

China has issued a temporary airspace restriction over Inner Mongolia for 3:20 to 3:50 a.m. Eastern (0820-0850 UTC, or 4:20-4:50 p.m. Beijing time) Nov. 14, according to a Notice to Airmen (NOTAM) published by the Hohhot Flight Information Region under the Civil Aviation Administration of China (CAAC).

The airspace closure notice matches an area covering the Dongfeng landing site, an area in Inner Mongolia roughly 60 to 90 kilometers to the east-southeast of the Jiuquan Satellite Launch Center, which has been used for all Shenzhou crewed spacecraft returns since 2021.

None of this is confirmed as yet, as China’s state-run press continues to be very secretive about this entire affair. It as yet not released any details about the damage to Shenzhou-20, nor has it been forthcoming with any details about the next steps it plans to take.