FAA red tape apparently stalling the next Starship/Superheavy orbital test launch

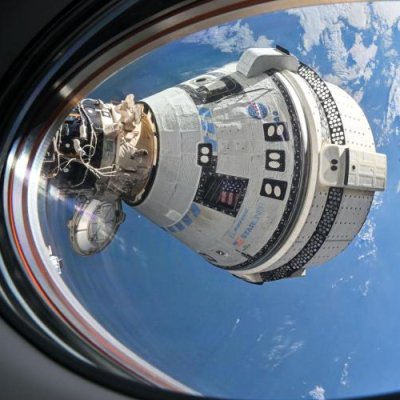

Superheavy being captured by the tower chopsticks at landing.

Click for video.

Back in mid-June, shortly after 4th orbital test flight of SpaceX’s Starship/Superheavy rocket, it appeared based on an FAA statement that the company could proceed with the next test flight as soon as it was ready to fly.

Subsequently, Elon Musk said the company expected to be ready by early August. There were also indications that the company wished to attempt a chopstick landing of Superheavy back at the launch tower at Boca Chica. Such an attempt however would require approval from the FAA, as the flight profile would not be the same as the previous flight.

I and others speculated that SpaceX would forego that chopstick landing in order to fly the fifth test flight quickly, while simultanously requesting permission from the FAA for such a landing on a later test flight. My thinking was that this would allow test flights to proceed with as little delay as possible.

Though it remains unknown whether or not the next test flight will include that chopstick landing attempt, it does appear that FAA red tape is blocking the next flight. In an update from NASASpaceflight.com about the work at Boca Chica posted on August 9, 2023 was a link to a SpaceX tweet the day before that said the following:

» Read more

Superheavy being captured by the tower chopsticks at landing.

Click for video.

Back in mid-June, shortly after 4th orbital test flight of SpaceX’s Starship/Superheavy rocket, it appeared based on an FAA statement that the company could proceed with the next test flight as soon as it was ready to fly.

Subsequently, Elon Musk said the company expected to be ready by early August. There were also indications that the company wished to attempt a chopstick landing of Superheavy back at the launch tower at Boca Chica. Such an attempt however would require approval from the FAA, as the flight profile would not be the same as the previous flight.

I and others speculated that SpaceX would forego that chopstick landing in order to fly the fifth test flight quickly, while simultanously requesting permission from the FAA for such a landing on a later test flight. My thinking was that this would allow test flights to proceed with as little delay as possible.

Though it remains unknown whether or not the next test flight will include that chopstick landing attempt, it does appear that FAA red tape is blocking the next flight. In an update from NASASpaceflight.com about the work at Boca Chica posted on August 9, 2023 was a link to a SpaceX tweet the day before that said the following:

» Read more