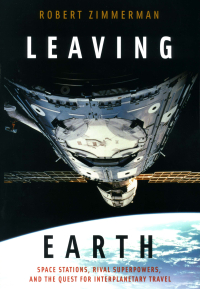

If a US spacewalk on ISS is necessary to repair its cooling system, the spare parts are there, but the spacesuits are not.

Prior to retiring the shuttle NASA, aware that cargo supply would be limited once the shuttle was gone, shipped up to the station as many spare parts as possible. Thus, there are three spare pump modules on ISS that could be installed during a spacewalk to replace the module that has the valve problem.

However, because of the water leak problem that occurred in one American spacesuit during a July spacewalk, NASA has halted all American spacewalks until replacement suits can be shipped up to the station.

Since then, NASA has been conducting extensive investigations into the water leak issue, with… “the crew performed a series of tests on EMU 3011 [the faulty spacesuit] as part of an ongoing effort for returning the suit back to service. The tests included water leak checks, communication checks, and suit pressure leak checks. EMU 3011 passed all tests.”

However, NASA had been planning to wait to return another EMU, serial number 3015, to Earth aboard a SpaceX Dragon vehicle and deliver a new EMU in its place before clearing EVAs to resume. However the next Dragon vehicle is not scheduled to arrive at the ISS until at least late February next year.

The Russians might be able to do this spacewalk, but they are going to demand payment for the work. And they won’t come cheap, considering the circumstances.