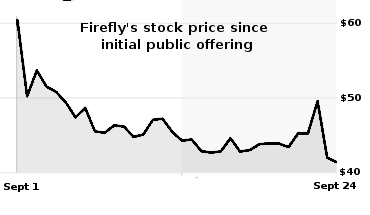

Firefly to provide the launch rocket for Kratos’ hypersonic test vehicles

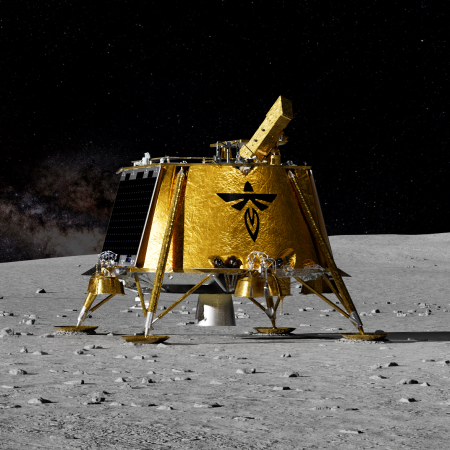

The rocket/lunar lander startup Firefly yesterday announced that it has signed a partnership deal with the hypersonic test startup Kratos.

In August Kratos partnered with the Australian company Hypersonix to build 20 scramjet test vehicles for the Pentagon for hypersonic test flights. Firefly with this new deal will provide the launch vehicle for getting those scramjets into the air at the speeds required. In fact, it appears Firefly is now going to do with its Alpha rocket the same thing that Rocket Lab did with its Electron rocket, revising it for suborbital testing.

Rocket Lab has already completed six successful HASTE launches. It will be interesting how quickly Firefly can get Alpha reconfigured and launched in this manner. Some of that schedule will also hinge on Kratos’ ability to provide the scramjets. The press release makes no mention of schedule.

Firefly’s action here continues the recent shift by many American space startups from rocketry and space exploration to defense work that is only tangentially related to space. It appears they are all diversifying to grab the expected rich contracts the Pentagon is expected to hand out to develop Trump’s proposed Golden Dome defense system. It also appears that many are diversifying because they have doubts the civilian space industry can sustain them, by itself.

The rocket/lunar lander startup Firefly yesterday announced that it has signed a partnership deal with the hypersonic test startup Kratos.

In August Kratos partnered with the Australian company Hypersonix to build 20 scramjet test vehicles for the Pentagon for hypersonic test flights. Firefly with this new deal will provide the launch vehicle for getting those scramjets into the air at the speeds required. In fact, it appears Firefly is now going to do with its Alpha rocket the same thing that Rocket Lab did with its Electron rocket, revising it for suborbital testing.

Rocket Lab has already completed six successful HASTE launches. It will be interesting how quickly Firefly can get Alpha reconfigured and launched in this manner. Some of that schedule will also hinge on Kratos’ ability to provide the scramjets. The press release makes no mention of schedule.

Firefly’s action here continues the recent shift by many American space startups from rocketry and space exploration to defense work that is only tangentially related to space. It appears they are all diversifying to grab the expected rich contracts the Pentagon is expected to hand out to develop Trump’s proposed Golden Dome defense system. It also appears that many are diversifying because they have doubts the civilian space industry can sustain them, by itself.