New Morgan Stanley report reflects Wall Street’s generally optimistic view of Rocket Lab

Though Rocket Lab is still not in the black, a new positive analysis of the company this week from Morgan Stanley reflects Wall Street’s generally optimistic view of Rocket Lab during the past year.

Rocket Lab (NASDAQ:RKLB) had its price target raised by equities researchers at Morgan Stanley from $20.00 to $68.00 in a research report issued on Monday, Benzinga reports. The brokerage presently has an “equal weight” rating on the rocket manufacturer’s stock. Morgan Stanley’s price target would suggest a potential upside of 1.63% from the company’s current price.

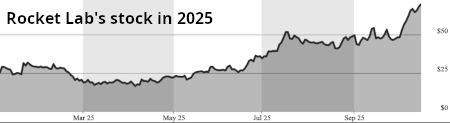

The article at the link also notes that Morgan Stanley is not alone in giving Rocket Lab a positive report, and in fact in the past year it shows that the recommendations from many analysts to buy its stock have risen considerably. These positive reviews have been reflected in a steady rise in the company’s stock price in 2025, as shown by the graph on the right.

Nor are these reports written in a vacuum. In recent weeks Rocket Lab has signed a bunch of new launch contracts, some extending deals with old customers, some with new customers of some note.

Buying the stock of a startup like Rocket Lab always carries risk, but it appears Wall Street is beginning to see the future of this particular startup as very promising.

Though Rocket Lab is still not in the black, a new positive analysis of the company this week from Morgan Stanley reflects Wall Street’s generally optimistic view of Rocket Lab during the past year.

Rocket Lab (NASDAQ:RKLB) had its price target raised by equities researchers at Morgan Stanley from $20.00 to $68.00 in a research report issued on Monday, Benzinga reports. The brokerage presently has an “equal weight” rating on the rocket manufacturer’s stock. Morgan Stanley’s price target would suggest a potential upside of 1.63% from the company’s current price.

The article at the link also notes that Morgan Stanley is not alone in giving Rocket Lab a positive report, and in fact in the past year it shows that the recommendations from many analysts to buy its stock have risen considerably. These positive reviews have been reflected in a steady rise in the company’s stock price in 2025, as shown by the graph on the right.

Nor are these reports written in a vacuum. In recent weeks Rocket Lab has signed a bunch of new launch contracts, some extending deals with old customers, some with new customers of some note.

Buying the stock of a startup like Rocket Lab always carries risk, but it appears Wall Street is beginning to see the future of this particular startup as very promising.