Three launches since yesterday

The beat goes on. Since yesterday there were three launches, one by China and two by SpaceX.

First, China’s Long March 8A rocket placed the twelfth set of satellites in the Guowang internet constellation, eventually aiming to be 13,000 satellites strong. China’s state-run press did not specify the exact number of satellites. Based on previous launches using the Long March 8A, the number was likely nine, bringing the number of this constellation’s satellites now in orbit to 96.

The launch was from China’s coastal Wenchang spaceport, and had a flight path that dumped the lower stages of the rocket near islands in the Philippines.

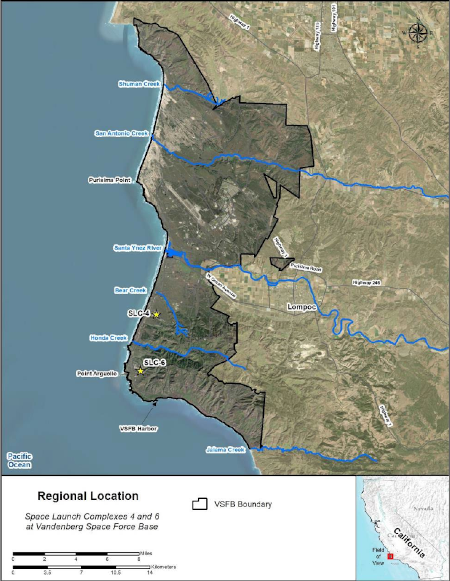

Next, SpaceX placed 21 satellites into orbit for the Pentagon, its Falcon 9 rocket lifting off from Vandenberg in California. This was the second launched by SpaceX for this military communication constellation, dubbed Tranche-1, intended to be 158 satellites total. The first stage completed its seventh flight, landing on a drone ship in the Pacific. The fairing halves completed their third and fourth flights respectively.

Finally, SpaceX launched another 28 Starlink satellites, its Falcon 9 rocket lifting off from Cape Canaveral in Florida. The first stage completed its third flight, landing on a drone ship in the Atlantic.

The leaders in the 2025 launch race:

133 SpaceX

61 China

13 Russia

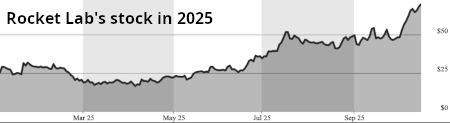

13 Rocket Lab

SpaceX now leads the rest of the world in successful launches, 133 to 102.

The beat goes on. Since yesterday there were three launches, one by China and two by SpaceX.

First, China’s Long March 8A rocket placed the twelfth set of satellites in the Guowang internet constellation, eventually aiming to be 13,000 satellites strong. China’s state-run press did not specify the exact number of satellites. Based on previous launches using the Long March 8A, the number was likely nine, bringing the number of this constellation’s satellites now in orbit to 96.

The launch was from China’s coastal Wenchang spaceport, and had a flight path that dumped the lower stages of the rocket near islands in the Philippines.

Next, SpaceX placed 21 satellites into orbit for the Pentagon, its Falcon 9 rocket lifting off from Vandenberg in California. This was the second launched by SpaceX for this military communication constellation, dubbed Tranche-1, intended to be 158 satellites total. The first stage completed its seventh flight, landing on a drone ship in the Pacific. The fairing halves completed their third and fourth flights respectively.

Finally, SpaceX launched another 28 Starlink satellites, its Falcon 9 rocket lifting off from Cape Canaveral in Florida. The first stage completed its third flight, landing on a drone ship in the Atlantic.

The leaders in the 2025 launch race:

133 SpaceX

61 China

13 Russia

13 Rocket Lab

SpaceX now leads the rest of the world in successful launches, 133 to 102.