House on Haunted Hill

An evening pause: For Halloween, I have decided to bring back this wonderfully staged classic from 1958, starring Vincent Price and directed by William Castle. No blood, no gore, but the worth every minute.

An evening pause: For Halloween, I have decided to bring back this wonderfully staged classic from 1958, starring Vincent Price and directed by William Castle. No blood, no gore, but the worth every minute.

Courtesy of BtB’s stringer Jay. This post is also an open thread. I welcome my readers to post any comments or additional links relating to any space issues, even if unrelated to the links below.

How it hopes to garner any business having any links to American aerospace technology I have no idea. There are many strict laws and State Department ITAR regulations prohibiting any American business from working in or with China.

On Christmas Eve 1968 three Americans became the first humans to visit another world. What they did to celebrate was unexpected and profound, and will be remembered throughout all human history. Genesis: the Story of Apollo 8, Robert Zimmerman's classic history of humanity's first journey to another world, tells that story, and it is now available as both an ebook and an audiobook, both with a foreword by Valerie Anders and a new introduction by Robert Zimmerman.

The print edition can be purchased at Amazon or any other book seller. If you want an autographed copy the price is $60 for the hardback and $45 for the paperback, plus $8 shipping for each. Go here for purchasing details. The ebook is available everywhere for $5.99 (before discount) at amazon, or direct from my ebook publisher, ebookit you don't support the big tech companies and the author gets a bigger cut much sooner.

"Not simply about one mission, [Genesis] is also the history of America's quest for the moon... Zimmerman has done a masterful job of tying disparate events together into a solid account of one of America's greatest human triumphs."--San Antonio Express-News

Cool image time! The picture to the right, cropped, reduced, and sharpened to post here, was taken on August 16, 2024 by the high resolution camera on Mars Reconnaissance Orbiter (MRO). The science team labels these strange features “ring-mound landforms,” a term that has been used to describe [pdf] only vaguely similar features previously found in the Athabasca flood lava plain almost on the other side of Mars. That paper suggested that those ring mounds formed on the “thin, brittle crust of an active fluid flow” created by an explosive event. Since Athabasca is considered Mars’s most recent major flood lava event, the fluid was likely lava, which on Mars flows more quickly and thinly in the lower gravity.

Thus, in Athabasca the ring-mounds formed when a pimple of molten lava from below popped the surface.

But what about the ring mounds in the picture to the right?

» Read more

What does the newly discovered election

fraud in PA tell us?

In the past week there have been a bunch of stories in the conservative press from three different counties in Pennsylvania, suggesting that each county has been swamped with thousands of fraudulent ballots, produced in bulk and then delivered in large numbers so as to make it difficult to trace or investigate them.

I decided to take a closer look, because this story could either be telling us how corrupt the upcoming election will be, or it might actually be telling us that it is going to be much more reliable than we have anticipated.

The three counties involved are Lancaster, York, and Monroe. All told, less than six thousand voter registration applications, all submitted apparently in bulk by a Arizona-based company called Field+Media Corps, were under review, the number from each county being 2,500, 3,087, and 30 respectively. Note that these do not appear to be actual ballots, but registration forms that would once approved would allow the individual to vote, either by mail or in person.

Of these applications, the reviews have already produced results. For example, York County has found that of the 3,087 submitted, 47% were verified and approved, 29% needed more information, and 24% were declined and are under further review. In Monroe County the investigation has apparently only flagged these 30 forms, with one coming from a deceased person and others flagged for different reasons that in the end might be legitimate.

In Lancaster County officials have not yet issued a report. Initially it announced:

» Read more

Now available in hardback and paperback as well as ebook!

From the press release: In this ground-breaking new history of early America, historian Robert Zimmerman not only exposes the lie behind The New York Times 1619 Project that falsely claims slavery is central to the history of the United States, he also provides profound lessons about the nature of human societies, lessons important for Americans today as well as for all future settlers on Mars and elsewhere in space.

“Zimmerman’s ground-breaking history provides every future generation the basic framework for establishing new societies on other worlds. We would be wise to heed what he says.” —Robert Zubrin, founder of the Mars Society.

All editions are available at Amazon, Barnes & Noble, and all book vendors, with the ebook priced at $5.99 before discount. All editions can also be purchased direct from the ebook publisher, ebookit, in which case you don't support the big tech companies and the author gets a bigger cut much sooner.

Autographed printed copies are also available at discount directly from the author (hardback $29.95; paperback $14.95; Shipping cost for either: $6.00). Just send an email to zimmerman @ nasw dot org.

Using both the Hubble and Webb space telescopes, astronomers have now produced multi-wavelength images of the galaxies NGC 2207and IC 2163, as shown to the right.

Millions of years ago the smaller galaxy, IC 2163, grazed against the larger, NGC 2207, resulting today in increased star formation in both galaxies, indicated by blue in the Hubble photo. From the caption of the combined images:

Combined, they are estimated to form the equivalent of two dozen new stars that are the size of the Sun annually. Our Milky Way galaxy forms the equivalent of two or three new Sun-like stars per year. Both galaxies have hosted seven known supernovae, each of which may have cleared space in their arms, rearranging gas and dust that later cooled, and allowed many new stars to form.

The two images to the left leaves the Hubble and Webb separate, making it easier to see the different features the different wavelengths reveal. From this caption:

In Hubble’s image, the star-filled spiral arms glow brightly in blue, and the galaxies’ cores in orange. Both galaxies are covered in dark brown dust lanes, which obscure the view of IC 2163’s core at left. In Webb’s image, cold dust takes centre stage, casting the galaxies’ arms in white. Areas where stars are still deeply embedded in the dust appear pink. Other pink dots may be objects that lie well behind these galaxies, including active supermassive black holes known as quasars.

The largest and brightest pink area in the Webb image, on the bottom right and a blue patch in the Hubble image, is where a strong cluster of star formation is presently occurring.

Russia today (October 31st in Russia) successfully launched a classified military satellite, its Soyuz-2 rocket lifting off from its Plesetsk spaceport in northern Russia.

The flight path took the satellite over the Arctic, where the rocket’s lower stages crashed harmlessly.

The leaders in the 2024 launch race:

107 SpaceX

49 China

12 Russia

11 Rocket Lab

American private enterprise still leads the rest of the world combined in successful launches 124 to 73, while SpaceX by itself still leads the entire world, including American companies, 107 to 90.

Leaving Earth: Space Stations, Rival Superpowers, and the Quest for Interplanetary Travel, can be purchased as an ebook everywhere for only $3.99 (before discount) at amazon, Barnes & Noble, all ebook vendors, or direct from my ebook publisher, ebookit.

If you buy it from ebookit you don't support the big oppressive tech companies and I get a bigger cut much sooner.

"Leaving Earth is one of the best and certainly the most comprehensive summary of our drive into space that I have ever read. It will be invaluable to future scholars because it will tell them how the next chapter of human history opened." -- Arthur C. Clarke

At a public meeting of the Texas Commission on Environmental Quality (TCEQ) on October 17, 2024 nearly four dozen anti-SpaceX activists apparently arrived en masse in order to overwhelm the public comment period with negative opinions about the company and its operation at Boca Chica.

The report at the link, from the San Antonio Express-News, is (as usual for a propaganda press outlet) decidedly in favor of these activists, and makes it sound as if these forty-plus individuals, apparently led by the activist group SaveRGV that has mounted most of the legal challenges to SpaceX, represent the opinions of the public at large.

What really happened here is that the Brownsville public has better things to do, like building businesses and making money, much of which now only exists because of SpaceX and that operation at Boca Chica. Thus, the only ones with time or desire to organize to show up at these kinds of meetings are these kinds of activists.

It might pay however for some of the more business-oriented organizations in Brownsville to make sure they are in the game at the next public meeting, scheduled for November 14, 2024 [pdf]. This would not be hard to do, and it would certainly help balance the scales, which at present are decidedly been warped by this small minority of protesters.

According to a tweet posted by SpaceX shortly after yesterday’s first launch from Vandenberg, the company needs only five more launches to complete its first constellation of Starlink direct-to-cell satellites.

More information here. At the moment the company has launched 260 of this version of its Starlink satellites. Since each launch places 13 more satellites in orbit, that means the first full iteration of the constellation will contain 325 satellites.

The satellites will allow cell phone users on the ground to use the constellations like a cell tower, thus providing service in areas where ground cell tower service does not exist. At the moment T-Mobile has a deal with SpaceX, so its subscribers will be able to use this service as soon as it is operational.

When when this be achieved? This story once again illustrates the speed in which SpaceX operates. The first launch of direct-to-cell Starlink satellites occurred on January 2, 2024, and in the last ten months the company has completed 23 launches to get the constellation where it is presently. At that pace the entire consellation might be complete before the end of this year.

The competition for this service is certainly fierce. The other satellite company offering this service, AST Mobile, has launched the first five satellites in its constellation, and has deals with AT&T and Verizon. Its design is different, and will only require 110 satellites to complete the constellation. At the moment five are about to become operational. It hopes to start regular launches next year to complete the constellation.

An evening pause: A prelude to Halloween. The visuals come from vintage 1920s and 1930s early cartoons, though the bulk comes from Walt Disney’s 1929 cartoon, Skeleton Dance.

Hat tip Judd Clark.

Courtesy of BtB’s stringer Jay. This post is also an open thread. I welcome my readers to post any comments or additional links relating to any space issues, even if unrelated to the links below.

SpaceX this afternoon completed its second launch today, its Falcon 9 rocket lifting off from Cape Canaveral carrying 23 Starlink satellites.

The first stage completed its fourteenth flight, landing on a drone ship in the Atlantic.

The earlier launch was from Vandenberg, also with a payload of Starlink satellites.

The leaders in the 2024 launch race:

107 SpaceX

49 China

11 Russia

11 Rocket Lab

American private enterprise now leads the rest of the world combined in successful launches 124 to 72, while SpaceX by itself still leads the entire world, including American companies, 107 to 89.

Cool image time! The picture to the right, cropped, reduced, and sharpened to post here, was taken on August 19, 2024 by the high resolution camera on Mars Reconnaissance Orbiter (MRO). Labeled merely as a “terrain sample,” it was likely snapped not for any specific research project, but to fill a gap in the camera schedule in order to maintain its proper temperature.

When the science team does this they try to pick interesting locations. Sometimes the picture is relatively boring. Sometimes, like the picture to the right, it reveals weird geology that is somewhat difficult to explain. The picture covers the transition from the smooth featureless plain to the north, and the twisting and complex ridges to the south, all of which are less than a few feet high.

Note the gaps. The downgrade here is to the west, and the gaps appear to vaguely indicate places where flows had occurred.

» Read more

SpaceX early this morning successfully launched another 20 Starlink satellites, its Falcon 9 rocket lifting off from Vandenberg in California.

The first stage completed its fourteenth flight, landing on a drone ship in the Pacific.

The leaders in the 2024 launch race:

106 SpaceX

49 China

11 Russia

11 Rocket Lab

American private enterprise now leads the rest of the world combined in successful launches 123 to 72, while SpaceX by itself still leads the entire world, including American companies, 106 to 89.

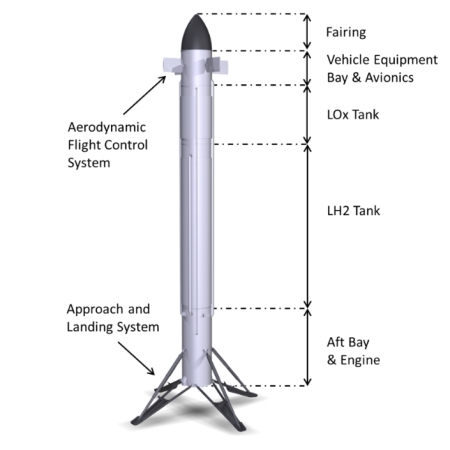

Callisto’s basic design

Japan’s space agency JAXA has now confirmed what France’s space agency CNES had revealed in August, that the first 100-meter-high hop of the government-proposed Callisto engineering Grasshopper-type test rocket will not take place any earlier than 2026.

This joint project of JAXA, CNES, and Germany’s space agency DLR was first proposed in 2015, and by 2018 was aiming for a 2020 launch. Four years past that target date and they are still not ready to launch. Remember too that even after it completes its test hop program an operational orbital rocket would have to be created. It does not appear this can easily be scaled up to fit Ariane-6.

SpaceX meanwhile conceived its Grasshopper vertical test prototype in 2011, began flying that year, and resulted in an actual Falcon 9 first stage landing in 2015. It has subsequently completed well over 300 actual commercial flights, reusing first stages up to 23 times.

The contrast between these government agencies and that private company is quite illustrative.

Proposed spaceports surrounding Norwegian Sea.

After multiple submissions of its plan to build a spaceport off the coast of Scotland, the Sutherland spaceport’s most recent proposal has finally been approved by the local council.

Most significant about the decision is that it rejected the legal objections of billionaire landowner Anders Holch Povlsen, who has previously fought the spaceport and is also an investor in the competing spaceport SaxaVord in the Shetland Islands. Povlsen had objected to the spaceport placing small tracking antennas on a nearby mountain where other larger communications antennas already operated.

This decison could still face the veto of the Scottish ministry. It will be no surprise if Povlsen uses his clout to cause difficulties at this level.

Meanwhile, it is more than two and a half years since Sutherland’s prime launch customer, Orbex, submitted its launch license to the United Kingdom’s Civil Aviation Authority (CAA), with no approval. At the moment the company hopes to launch next year.

Embedded below the fold in two parts.

To listen to all of John Batchelor’s podcasts, go here.

» Read more

Courtesy of BtB’s stringer Jay. This post is also an open thread. I welcome my readers to post any comments or additional links relating to any space issues, even if unrelated to the links below.

China today successfully launched a new three-person crew to its Tiangong-3 space station, its Long March 2F rocket lifting off from its Jiuquan spaceport in northwest China.

No word on where the rocket’s side boosters or lower stages, using toxic hypergolic fuel, crashed inside China. The crew will dock with the station mid-day tomorrow.

The leaders in the 2024 launch race:

105 SpaceX

49 China

11 Russia

11 Rocket Lab

American private enterprise still leads the rest of the world combined in successful launches 122 to 72, while SpaceX by itself still leads the entire world, including American companies, 105 to 89.

Fight! Fight! Fight! Six workers who were fired from San Francisco’s

BART subway system for refusing to get a COVID jab have won a $7.8 million judgment from a jury, with each person taking home more than a million dollars in damages.

The employees claimed religious exemptions to the vaccine mandate but say they were not accommodated by the transit agency, and subsequently lost their job.

BART did initially grant vaccine exemptions, but the plaintiffs argued they weren’t accommodated. An accommodation could have meant that they were able to work from home or get tested regularly for COVID. They argued none of that happened and they lost their jobs.

More information here and here. There were not the only fired employees who sued. Another sixteen had sued and then settled in July. It also appears that further suits by fired employees are pending.

Do not expect these stories to stop. Over the next five years we will see story after story of blacklisted individuals winning case after case, because almost all the blacklisting in the past five years due to politics, COVID, and racial bigotry has been blatantly illegal, not only breaking numerous civil rights laws but in direct violation of the Constitution, the Bill of Rights, and the very fundamental principles of American culture. When these cases get before juries, the plantiffs are going to win, and win big, as these former BART employees have.

Charles Duke, Apollo 16 astronaut

Yesterday I had to pleasure of getting my second tour of the Phantom Space facilities, located here in Tucson. Jim Cantrell, the founder of the Tucson-based rocket/satellite company Phantom Space, had last week graciously invited me to attend the event he was holding there, where astronaut Charles Duke, from the April 1972 Apollo 16 lunar landing, would be giving a talk to the company’s employees, investors, and customers. Duke had become an advisor for the company, and this would be his first visit to its operations.

First, the talk by Charles Duke, describing his life and Apollo 16 walk on the Moon, was as usual awe-inspiring, mostly because Duke spoke like every astronaut I’ve ever met so matter-of-factly about what he had done. During the second of three excusions on the surface with his commander John Young, they drove their rover up the slope of nearby Stone Mountain, climbing to an elevation of 500 feet, the highest any human has so far been on the lunar surface. From there he could look back and see for miles, including the entire valley where the lunar module was nestled as well as the mountains and craters that surrounded it.

When I asked him if he had had any sense of his remoteness from humanity, his response was a good-natured laugh. “We felt at home there!” They had done so much study of the terrain beforehand, including simulations, that from the moment they approached to land it all looked very familiar. This is where they were supposed to be!

Following Duke’s presentation we all were given a tour of the facility. My first visit there had been in 2022. At the time Cantrell’s effort was to aggressively succeed from his earlier failure at the rocket startup Vector, focusing this new company on building its Daytona rocket. After the tour I concluded as follows:

» Read more

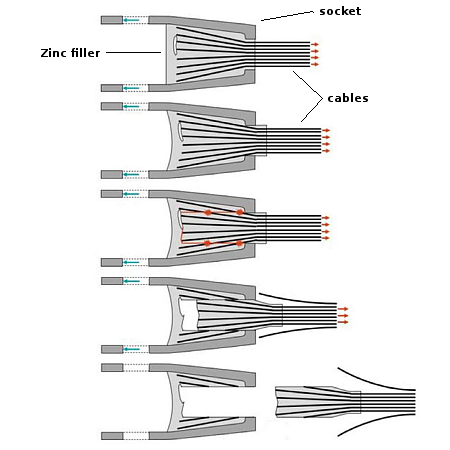

According to a new very detailed engineering analysis into the causes of the collapse of the Arecibo radio telescope in Puerto Rico in 2020, the failure was caused first by a surprising interaction between the radio electronics of Arecibo and the traditional methods used to anchor the cables, and second by a failure of inspections to spot the problem as it became obvious.

The surprising engineering discovery is illustrated to the right, taken from figure 2-6 of the report. The main antenna of Arecibo was suspended above the bowl below by three main cables. The figure shows the basic design of the system used to anchor the cable ends to their sockets. The end of the cable bunches would be inserted into the socket, spread apart, and then zinc would be poured in to fill the gap and then act as a plug and glue to hold the cables in place. According to the report, this system has been used for decades in many applications very successfully.

What the report found however was at Arecibo over time the cable bunch and zinc plug slowly began to pull out of the socket, what the report labels as “zinc creep.” This was noted by inspectors, but dismissed as a concern because they still believed the engineering margins were still high enough to prevent failure at this point. In fact, this is exactly where the structure failed in 2020, with the first cable separating as shown in August 2020. The second cable did so in a similar manner in November 2020.

The report concluded that the “only hypothesis the committee could develop that provides a plausible but unprovable answer to all these questions and the observed socket failure pattern is that the socket zinc creep was unexpectedly accelerated in the Arecibo Telescope’s uniquely powerful electromagnetic radiation environment. The Arecibo Telescope cables were suspended across the beam of ‘the most powerful radio transmitter on Earth.'”

The report however also notes that the regular engineering inspections of the telescope had spotted this creep, which was clearly unusual and steadily becoming significant, and did not take action to address the issue when it should have. It also noted the slow response of the bureaucracy, not only to the damage caused earlier to the facility by Hurriane Maria in 2017, but to obtaining the funding for any repairs.

Ray Lugo [the principal investigator for Arecibo] described to the committee how months of his time during 2018 were spent writing, resubmitting, and justifying repair funding proposals. Repairs had to go through the traditional “bid and proposal” process, described in more detail below, which added years of delay.

We can forgive the inspectors somewhat for not noting the creep when they should, as its cause appears to be very unusual, still uncertain and rare, but the red tape that prevented proper and quick repair effort after the hurricane is shameful. Had the telescope gotten the proper support on time, the creep itself might have even been addressed, because the resources would have been there to deal with it.

AST SpaceMobile has now successfully unfolded the large array antennas on all five the satellites it launched in September, and did so six weeks ahead of schedule.

“The unfolding of the first five commercial satellites is a significant milestone for the company. These five satellites are the largest commercial communications arrays ever launched in low Earth orbit,” commented Abel Avellan, founder, Chairman and CEO of AST SpaceMobile, in a statement. “It is a significant achievement to commission these satellites, and we are now accelerating our path to commercial activity.”

The satellites are designed to act like cell towers in space, providing direct satellite-to-cellphone coverage and fill gaps in ground-based cell service. ATT has already signed a contract with AST to use these satellites.

In attempting to explain the existence of flow features that have been found on the interior walls of craters on the asteroids Ceres and Vesta — as shown in the image above — scientists recently performed a laboratory experiment which determined that a mixture of water and salt could produce those gullies.

The team modified a test chamber at the Jet Propulsion Laboratory to rapidly decrease pressure over a liquid sample to simulate the dramatic drop in pressure as the temporary atmosphere created after an impact on an airless body like Vesta dissipates. According to Poston, the pressure drop was so fast that test liquids immediately and dramatically expanded, ejecting material from the sample containers.

“Through our simulated impacts, we found that the pure water froze too quickly in a vacuum to effect meaningful change, but salt and water mixtures, or brines, stayed liquid and flowing for a minimum of one hour,” said Poston. “This is sufficient for the brine to destabilize slopes on crater walls on rocky bodies, cause erosion and landslides, and potentially form other unique geological features found on icy moons.”

The press release makes it sound as if this result makes the existence of subsurface water ice more likely on such asteroids as Ceres and Vesta, but previous research from the Dawn asteroid probe made that fact very clear, especially for Ceres, years ago. All this does is provide some evidence of what might be one process by which these erosion gullies form.

Hat tip to reader Milt.

Click for full resolution annotated image. Click here for unannotated full resolution image.

Cool image time! The panorama above, cropped, reduced, and sharpened to post here, was assembled from 44 pictures taken by the rover Perseverance on September 27, 2024 as it began its climb up the rim of Jezero Crater. If you click on it you can see the full resolution image that is also annotated to identify features within the crater as well as places where Perseverance has traveled.

The overview map below, with the blue dot showing the rover’s location when this panorama was taken. The yellow lines indicate the area covered by the panorama, with the arrow indicating the direction.

According to the information at the link, the rover has been experiencing some slippery sandy ground as it has been climbing.

» Read more

Engineers on the ground have now established good communications with the two cubesats that are being carried by the European probe Hera on its way to the binary asteroids Didymos and Dimorphos.

“Each CubeSat was activated for about an hour in turn, in live sessions with the ground to perform commissioning – what we call ‘are you alive?’ and ‘stowed checkout’ tests,” explains ESA’s Hera CubeSats Engineer Franco Perez Lissi.

…Travelling with Hera are two shoebox-sized ‘CubeSats’ built up from standardised 10-cm boxes. These miniature spacecraft will fly closer to the asteroid than their mothership, taking additional risks to acquire valuable bonus data.

Juventas, produced for ESA by GOMspace in Luxembourg will make the first radar probe within an asteroid, while Milani, produced for ESA by Tyvak International in Italy, will perform multispectral mineral prospecting.

This use of small cubesats in conjunction with a larger interplanetary probe is becoming increasingly routine, and provides a cheap and efficient way to increase the data and information obtained. Note too that both cubesats were apparently built entirely by private companies, thus establishing their creditionals as providers of interplanetary probes.

The private commercial space tracking company ExoAnalytic has now identified more than 500 pieces from Intelsat 33e satellite breakup.

Some of the smaller debris might actually quickly disappear as these pieces are possibly bits of solid fuel that will evaporate.

Much of the press has suddenly decided this failure is all Boeing’s fault, because the satellite was built by that company a decade ago. This seems a bit unfair, since Boeing’s problems now seem far removed from its design and construction of satellites then. At the same time one must wonder. Boeing built four of these type satellites for Intelsat, and the first was lost in 2019 when either it was hit by a meteor or had “a wiring flaw, which led to an electrostatic discharge following heightened solar weather activity.”

That means two of the four satellites have been lost, though the second, 33e, didn’t break-up until twelve years of operation, almost its expected lifespan. Furthermore, the other two satellites are still working fine.

All in all, that suggests to me that though there may be a technical cause that can be traced back to the company, it is more likely we are simply seeing a random expression of the dangers of space to engineering, by anyone.

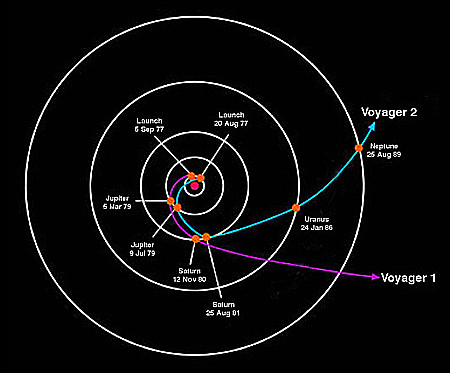

The routes the Voyager spacecraft have

taken since launch.

According to a NASA report yesterday, engineers are dealing with a new technical problem that has occurred Voyager-1, flying out beyond the edge of the solar system.

On Oct. 16, the flight team sent a command to turn on one of the spacecraft’s heaters. While Voyager 1 should have had ample power to operate the heater, the command triggered the fault protection system. The team learned of the issue when the Deep Space Network couldn’t detect Voyager 1’s signal on Oct. 18.

The spacecraft typically communicates with Earth using what’s called an X-band radio transmitter, named for the specific frequency it uses. The flight team correctly hypothesized that the fault protection system had lowered the rate at which the transmitter was sending back data. This mode requires less power from the spacecraft, but it also changes the X-band signal that the Deep Space Network needs to listen for. Engineers found the signal later that day, and Voyager 1 otherwise seemed to be in a stable state as the team began to investigate what had happened.

Then, on Oct. 19, communication appeared to stop entirely. The flight team suspected that Voyager 1’s fault protection system was triggered twice more and that it turned off the X-band transmitter and switched to a second radio transmitter called the S-band. While the S-band uses less power, Voyager 1 had not used it to communicate with Earth since 1981. It uses a different frequency than the X-band transmitters signal is significantly fainter. The flight team was not certain the S-band could be detected at Earth due to the spacecraft’s distance, but engineers with the Deep Space Network were able to find it.

Though communications with the spacecraft continue, no data can be downloaded and work is essentially suspended while engineers troubleshoot why Voyager-1 kept initiating its fault system.

It is amazing that communications were still possible using the S-band after more than forty years. I would bet that no engineers from then still work at the Deep Space Network. Kudos to the engineers there now for finding the signal.

Courtesy of BtB’s stringer Jay. This post is also an open thread. I welcome my readers to post any comments or additional links relating to any space issues, even if unrelated to the links below.

This is late today because I was attending an event at the local Tucson rocket startup Phantom Space. More on that tomorrow.

An evening pause: Hat tip Tom Biggar, who notes this is quite “an interesting blend of instruments. The orchestra prides itself on giving you the “harmonica at its best!”