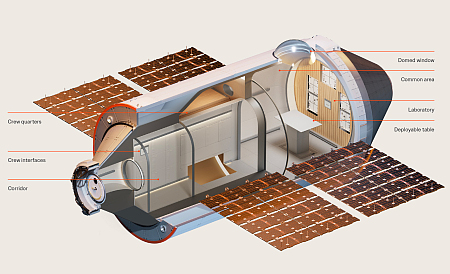

Vast unveils its first preliminary design for the interior of its Haven-1 space station

Artist’s rendering of Haven-1 interior.

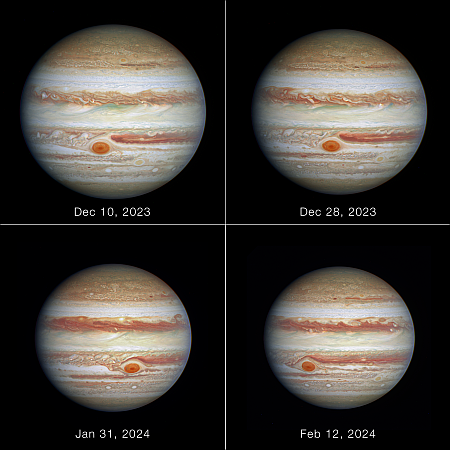

Click for original.

Vast today revealed its first preliminary design for the interior of its Haven-1 space station that it hopes to launch in the second half of 2026 and immediately occupy with four astronauts for a 30-day mission.

After docking with a SpaceX Dragon spacecraft, Haven-1 crew members open the Haven-1 exterior hatch and are greeted by a sleek, functional layout upon entry. A real-time display shows the station status with temperature and lighting controls, and optimized cargo compartments ensure essential supplies are stored efficiently. Notably, Haven-1’s interior surfaces are soft and padded to provide an added safety component for crew and visitors as they float throughout.

Above and below the corridor, the station’s four private crew quarters offer astronauts a space to rest and recharge. Slightly larger than the crew quarters aboard the ISS, these expanded personal rooms are uniquely designed to allow for changing, entertainment, online communication with loved ones back on Earth (enabled by SpaceX Starlink connectivity), and, most importantly, a good night’s rest. Experience has shown that sleeping in space can be a restless endeavor. Maximizing sleep efficiency and comfort remains critical to the overall experience aboard the Vast station. Historically, zero gravity sleep has been uncomfortable for astronauts due to a lack of standardized and consistent restraint systems during weightless sleep and a deficit in the distributed gravity forces humans are accustomed to on Earth. Vast’s patent-pending signature sleep system is roughly the size of a queen bed, provides a customized amount of equal pressure throughout the night, and accommodates side and back sleepers alike.

Additionally, each room features a built-in storage compartment, vanity, and a custom amenities kit

Beyond the corridor with the crew quarters is a common area which also includes a laboratory rack system on one wall, where experiments can be installed, monitored, and performed.

Overall the interior of this single module station in many ways harks back to the early Soviet Salyut stations, as the amount of interior space is somewhat comparable. One feature of Vast’s design however that is truly original is the use of “genuine safety-tested, fire-resistant maple wood veneer slats” on the interior’s walls.

Though definitely designed with that 30-day mission in mind, this first release clearly looks preliminary, with the graphics appearing far simpler than things will look in reality.

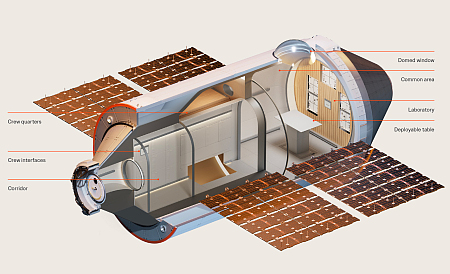

Artist’s rendering of Haven-1 interior.

Click for original.

Vast today revealed its first preliminary design for the interior of its Haven-1 space station that it hopes to launch in the second half of 2026 and immediately occupy with four astronauts for a 30-day mission.

After docking with a SpaceX Dragon spacecraft, Haven-1 crew members open the Haven-1 exterior hatch and are greeted by a sleek, functional layout upon entry. A real-time display shows the station status with temperature and lighting controls, and optimized cargo compartments ensure essential supplies are stored efficiently. Notably, Haven-1’s interior surfaces are soft and padded to provide an added safety component for crew and visitors as they float throughout.

Above and below the corridor, the station’s four private crew quarters offer astronauts a space to rest and recharge. Slightly larger than the crew quarters aboard the ISS, these expanded personal rooms are uniquely designed to allow for changing, entertainment, online communication with loved ones back on Earth (enabled by SpaceX Starlink connectivity), and, most importantly, a good night’s rest. Experience has shown that sleeping in space can be a restless endeavor. Maximizing sleep efficiency and comfort remains critical to the overall experience aboard the Vast station. Historically, zero gravity sleep has been uncomfortable for astronauts due to a lack of standardized and consistent restraint systems during weightless sleep and a deficit in the distributed gravity forces humans are accustomed to on Earth. Vast’s patent-pending signature sleep system is roughly the size of a queen bed, provides a customized amount of equal pressure throughout the night, and accommodates side and back sleepers alike.

Additionally, each room features a built-in storage compartment, vanity, and a custom amenities kit

Beyond the corridor with the crew quarters is a common area which also includes a laboratory rack system on one wall, where experiments can be installed, monitored, and performed.

Overall the interior of this single module station in many ways harks back to the early Soviet Salyut stations, as the amount of interior space is somewhat comparable. One feature of Vast’s design however that is truly original is the use of “genuine safety-tested, fire-resistant maple wood veneer slats” on the interior’s walls.

Though definitely designed with that 30-day mission in mind, this first release clearly looks preliminary, with the graphics appearing far simpler than things will look in reality.