Scientists detect methane gas on the dwarf planet Makemake orbiting the Sun beyond Neptune

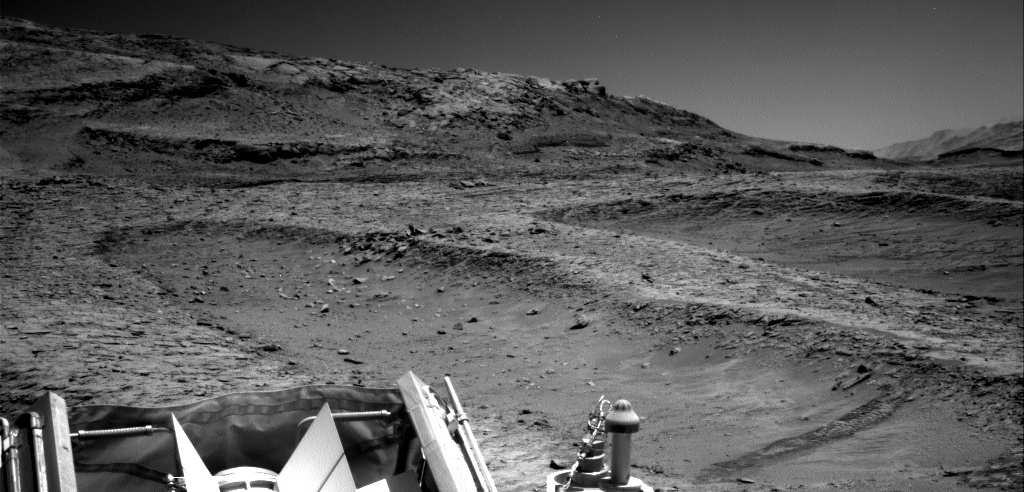

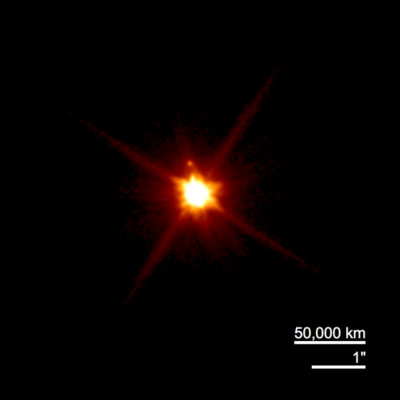

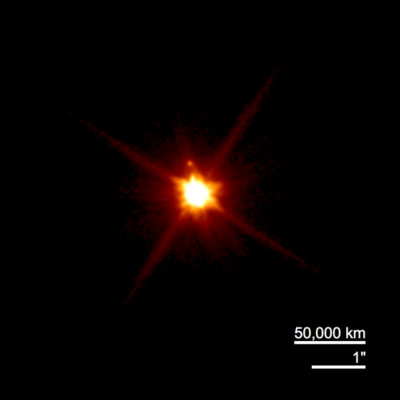

Makemake and the discovery of its small moon,

as seen by Hubble in 2016. Click for original image.

Using the Webb Space Telescope, scientists have identified the spectroscopic signal of methane gas on the dwarf planet Makemake that orbits the Sun in the Kuiper belt, suggesting this planet like Pluto might have an intermittent atmosphere.

At about 890 miles (1,430 km) in diameter and two-thirds the size of Pluto, Makemake has long been a source of scientific intrigue. Stellar occultations suggested that it lacked a substantial global atmosphere, though a thin one could not be ruled out. Meanwhile, infrared data of Makemake — including JWST measurements — hinted at puzzling thermal anomalies and unusual characteristics of its methane ice, which raised the possibility of localized hot spots across its surface and potential outgassing.

…“This discovery raises the possibility that Makemake has a very tenuous atmosphere sustained by methane sublimation,” said Dr. Emmanuel Lellouch of the Paris Observatory, another co-author of the study. “Our best models point to a gas temperature around 40 Kelvin (-233 degrees Celsius) and a surface pressure of only about 10 picobars — that is, 100 billion times below Earth’s atmospheric pressure, and a million times more tenuous than Pluto’s. If this scenario is confirmed, Makemake would join the small handful of outer solar system bodies where surface–atmosphere exchanges are still active today.”

It is also possible that the methane gas detected could be coming from volcanic plumes, not unlike the plumes found on the Saturn moon Enceladus.

These results prove once again that even though planets like Pluto and Makemake sit very far from the Sun and thus get little energy from it, they can still have active geological processes. Of all the discoveries produced by New Horizons when it flew past Pluto in 2015, this discovery was the most significant.

Makemake and the discovery of its small moon,

as seen by Hubble in 2016. Click for original image.

Using the Webb Space Telescope, scientists have identified the spectroscopic signal of methane gas on the dwarf planet Makemake that orbits the Sun in the Kuiper belt, suggesting this planet like Pluto might have an intermittent atmosphere.

At about 890 miles (1,430 km) in diameter and two-thirds the size of Pluto, Makemake has long been a source of scientific intrigue. Stellar occultations suggested that it lacked a substantial global atmosphere, though a thin one could not be ruled out. Meanwhile, infrared data of Makemake — including JWST measurements — hinted at puzzling thermal anomalies and unusual characteristics of its methane ice, which raised the possibility of localized hot spots across its surface and potential outgassing.

…“This discovery raises the possibility that Makemake has a very tenuous atmosphere sustained by methane sublimation,” said Dr. Emmanuel Lellouch of the Paris Observatory, another co-author of the study. “Our best models point to a gas temperature around 40 Kelvin (-233 degrees Celsius) and a surface pressure of only about 10 picobars — that is, 100 billion times below Earth’s atmospheric pressure, and a million times more tenuous than Pluto’s. If this scenario is confirmed, Makemake would join the small handful of outer solar system bodies where surface–atmosphere exchanges are still active today.”

It is also possible that the methane gas detected could be coming from volcanic plumes, not unlike the plumes found on the Saturn moon Enceladus.

These results prove once again that even though planets like Pluto and Makemake sit very far from the Sun and thus get little energy from it, they can still have active geological processes. Of all the discoveries produced by New Horizons when it flew past Pluto in 2015, this discovery was the most significant.