Mars rover update

It is time for an update on the journeys of Curiosity and Opportunity on Mars!

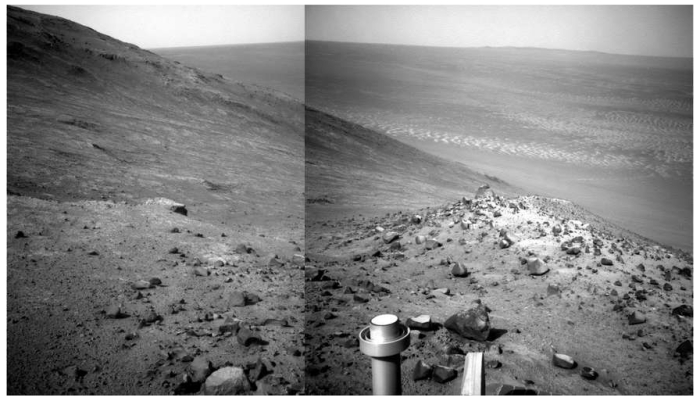

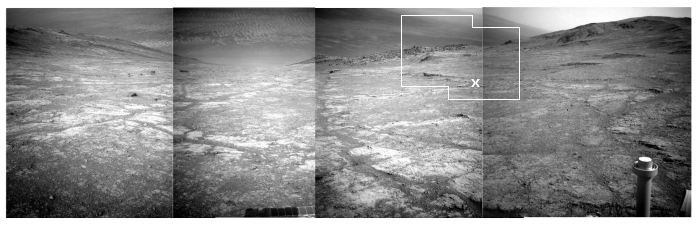

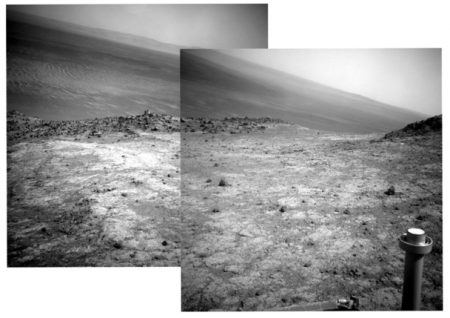

First, Curiosity. Though the science team has not yet updated the rover’s Mars Reconnaissance Orbiter traverse map showing its travels, it appears from Curiosity’s most recent navigation camera images that the rover has moved passed the first butte that had been ahead and directly to the south in the traverse map shown in the last image of my post here. The image below the fold, cropped and reduced to show here, looks ahead to the second butte and the gap to the south. Beyond Mt Sharp can be seen rising up on the right, with the upcoming ground open and relatively smooth. The only issue will be the steepness of that terrain. Based on my previous overall look at the rover’s journey, I suspect they will contour to the left.

» Read more

It is time for an update on the journeys of Curiosity and Opportunity on Mars!

First, Curiosity. Though the science team has not yet updated the rover’s Mars Reconnaissance Orbiter traverse map showing its travels, it appears from Curiosity’s most recent navigation camera images that the rover has moved passed the first butte that had been ahead and directly to the south in the traverse map shown in the last image of my post here. The image below the fold, cropped and reduced to show here, looks ahead to the second butte and the gap to the south. Beyond Mt Sharp can be seen rising up on the right, with the upcoming ground open and relatively smooth. The only issue will be the steepness of that terrain. Based on my previous overall look at the rover’s journey, I suspect they will contour to the left.

» Read more