Without doubt there remain great risks and real constitutional issues involved the present military campaign by both the United States and Israel to destroy the Islamic leadership in Iran. First, it is almost impossible to force a change in power solely by air power. This has been tried numerous times, with little success. Killing the leaders of this terrorist Iranian government is a positive step, but it remains entirely unclear whether this war can produce a better government there.

Second, as much as there might be legal precedents that allow President Trump to initiate this action without direct congressional approval, it continues a dangerous trend ceding power away from Congress and to the presidency, in direct opposition to the intentions of the Founding Fathers in their writing of the Constitution. They very much were opposed to giving any president the power to start a war unilaterally.

Click here and here for original videos.

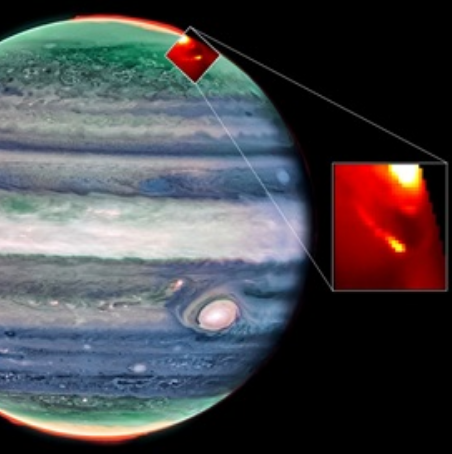

Having stated the reasonable objections to this military action, however, we must now take a look at the two images to the right to see its immediate and very positive consequences. Both pictures are from videos of very spontaneous demonstrations on February 28, 2026 by Iranian refugees celebrating the American/Israeli attacks against Iran.

The top picture is a screen capture from a demonstration in Georgetown, DC. The bottom picture is a screen capture from a demonstration in Austin, Texas.

Note the flags in both pictures. There are numerous flags of Iran (the version during the Shah’s rule, not the version from the Islamic Revolution). There are many American flags, of course, since these demonstrations are in America.

What is most revealing however are the Israeli flags, being enthusiastically waved by Iranians. Clearly the decades of hate against Israel and Jews by the mullahs in Iran has not had any impact on these Iranian refugees. In fact, in the video of the bottom picture they are chanting “Thank you, Bibi!”, referring to Israel’s leader Benjamin Netanyahu as the camera pans across the crowd.

Moreover, these demonstrations took place in two Democratic Party strongholds, cities where pro-Hamas demonstrations have been routine, including rioting and violence against Jews and anyone who dared suggest Israel’s actions in Gaza might be justified.

Nor are these two demonstrations an exception. They have been the rule across the United States and Europe, as well as in Iran itself. The public — the ordinary people for whom governments are meant to serve — seem very much in favor of what President Trump and Netanyahu are doing in Iran. And they are expressing that support of both America and Israel quite unequivocally. If this doesn’t indicate to the world that Israel and the rest of the Middle East can live together in peace and mutual cooperation, nothing can.

This conclusion is further supported by the response by almost every Arab nation in the Middle East, most of whom started off quite willing to let the U.S. and Israel do this deed, with no opposition or with covert support. Now, because of Iran’s indiscriminate attacks on Arab nations, they have all publicly joined the war, allying themselves not with the Islamic nation of Iran but with the U.S. and Israel.

I would not be surprised if Saudi Arabia soon signs the Abraham Accords. Nor would I be surprised if most of the last remaining Arab nations that have not yet done so join Saudi Arabia.

We could very well be seeing a major realignment of alliances in the Middle East that could really really harbinger the beginnings of real peace in that region. Imagine: Israel at peace with all its neighbors, because the Arabs have finally recognized that it is to their own best interest to do so as well.