Fractures in the floor of Occator Crater

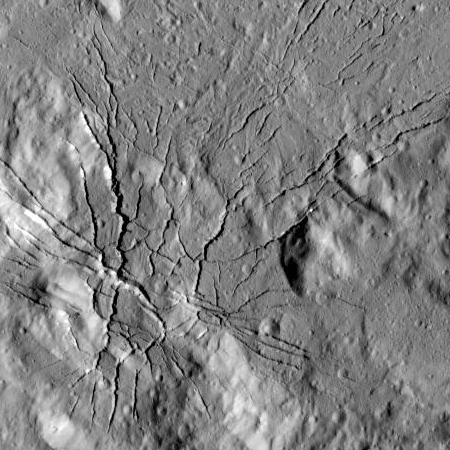

Cool image time! The Dawn science team has released an image of Ceres, cropped to post here in the right, that shows a spiderweb of fractures radiating out from a single point in the floor of Occator Crater.

These fractures have been interpreted as evidence that material came up from below and formed a dome shape, as if a piston was pushing Occator’s floor from beneath the surface. This may be due to the upwelling of material coming from Ceres’ deep interior. An alternative hypothesis is that the deformation is due to volume changes inside a reservoir of icy magma in the shallow subsurface that is in the process of freezing, similar to the change in volume that a bottle of water experiences when put in a freezer.

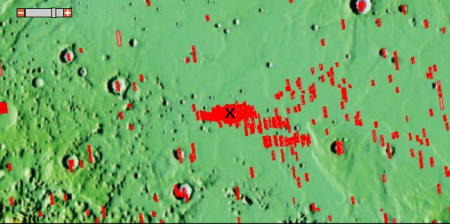

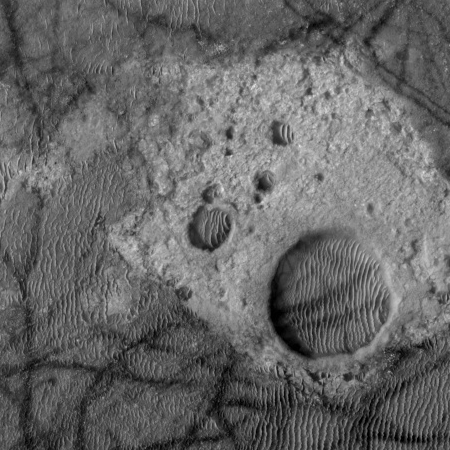

In the image sunlight is coming from the right. This fractured area can be seen in this earlier simulated oblique image of Occator Crater, in the southwest corner of the crater floor, well away from the crater’s more well known bright areas.

Cool image time! The Dawn science team has released an image of Ceres, cropped to post here in the right, that shows a spiderweb of fractures radiating out from a single point in the floor of Occator Crater.

These fractures have been interpreted as evidence that material came up from below and formed a dome shape, as if a piston was pushing Occator’s floor from beneath the surface. This may be due to the upwelling of material coming from Ceres’ deep interior. An alternative hypothesis is that the deformation is due to volume changes inside a reservoir of icy magma in the shallow subsurface that is in the process of freezing, similar to the change in volume that a bottle of water experiences when put in a freezer.

In the image sunlight is coming from the right. This fractured area can be seen in this earlier simulated oblique image of Occator Crater, in the southwest corner of the crater floor, well away from the crater’s more well known bright areas.