Russian engineers pinpoint approximate crash site of Luna-25

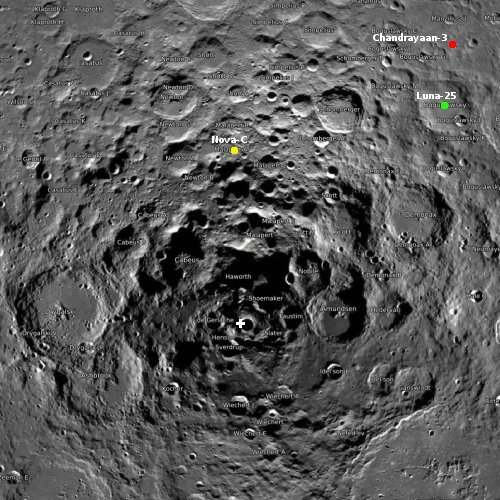

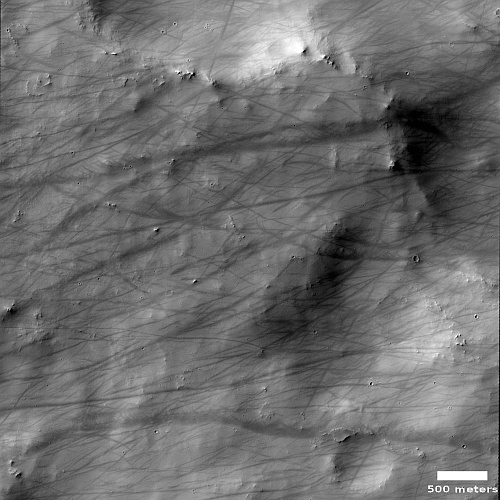

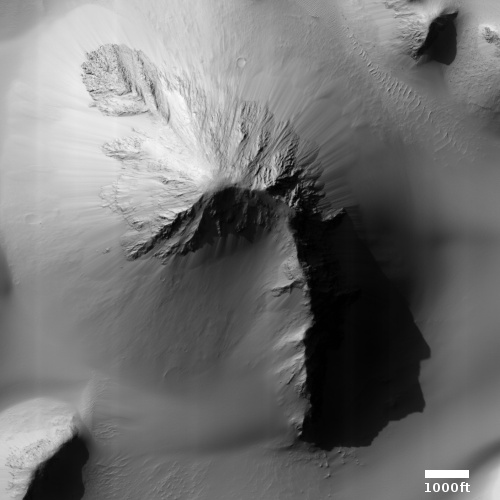

Russian engineers have pinpointed the approximate crash site of Luna-25 on the Moon as the 42-mile-wide crater Pontecoulant G, located at about 59 degrees south latitude, 66 east longitude.

Researchers from the Russian Academy of Sciences’ Keldysh Institute of Applied Mathematics have simulated the trajectory of the Luna-25 mission, figuring out where and when it crashed into the moon’s surface, the institute said in a statement on Telegram. “The mathematical modeling of the trajectory of the Luna-25 spacecraft, carried out by experts from the Ballistic Center of the Russian Academy of Sciences’ Keldysh Institute of Applied Mathematics, made it possible to determine the time and place of its collision with the moon,” the statement reads.

According to the institute, the spacecraft fell into the 42-kilometer Pontecoulant G crater in the southern hemisphere of the moon at 2:58 p.m. Moscow time on August 19.

The planned landing site, in Boguslawsky Crater at 73 degrees south latitude and 43 degrees east longitude, was many miles away.

Russian engineers have pinpointed the approximate crash site of Luna-25 on the Moon as the 42-mile-wide crater Pontecoulant G, located at about 59 degrees south latitude, 66 east longitude.

Researchers from the Russian Academy of Sciences’ Keldysh Institute of Applied Mathematics have simulated the trajectory of the Luna-25 mission, figuring out where and when it crashed into the moon’s surface, the institute said in a statement on Telegram. “The mathematical modeling of the trajectory of the Luna-25 spacecraft, carried out by experts from the Ballistic Center of the Russian Academy of Sciences’ Keldysh Institute of Applied Mathematics, made it possible to determine the time and place of its collision with the moon,” the statement reads.

According to the institute, the spacecraft fell into the 42-kilometer Pontecoulant G crater in the southern hemisphere of the moon at 2:58 p.m. Moscow time on August 19.

The planned landing site, in Boguslawsky Crater at 73 degrees south latitude and 43 degrees east longitude, was many miles away.