SpaceX launches 29 more Starlink satellites

SpaceX today successfully launched another 29 Starlink satellites, its Falcon 9 rocket lifting off from Cape Canaveral in Florida.

The first stage completed its 25th flight, landing on a drone ship in the Atlantic. With this flight, this booster, B1077, has now tied the space shuttle Endeavour in reuses, and is only three behind the Columbia shuttle.

The leaders in the 2025 launch race:

158 SpaceX (a new record)

74 China

15 Rocket Lab

15 Russia

SpaceX now leads the rest of the world in successful launches, 158 to 126.

SpaceX today successfully launched another 29 Starlink satellites, its Falcon 9 rocket lifting off from Cape Canaveral in Florida.

The first stage completed its 25th flight, landing on a drone ship in the Atlantic. With this flight, this booster, B1077, has now tied the space shuttle Endeavour in reuses, and is only three behind the Columbia shuttle.

The leaders in the 2025 launch race:

158 SpaceX (a new record)

74 China

15 Rocket Lab

15 Russia

SpaceX now leads the rest of the world in successful launches, 158 to 126.

On Christmas Eve 1968 three Americans became the first humans to visit another world. What they did to celebrate was unexpected and profound, and will be remembered throughout all human history. Genesis: the Story of Apollo 8, Robert Zimmerman's classic history of humanity's first journey to another world, tells that story, and it is now available as both an ebook and an audiobook, both with a foreword by Valerie Anders and a new introduction by Robert Zimmerman.

The print edition can be purchased at Amazon or any other book seller. If you want an autographed copy the price is $60 for the hardback and $45 for the paperback, plus $8 shipping for each. Go here for purchasing details. The ebook is available everywhere for $5.99 (before discount) at amazon, or direct from my ebook publisher, ebookit you don't support the big tech companies and the author gets a bigger cut much sooner.

The audiobook is also available at all these vendors, and is also free with a 30-day trial membership to Audible.

"Not simply about one mission, [Genesis] is also the history of America's quest for the moon... Zimmerman has done a masterful job of tying disparate events together into a solid account of one of America's greatest human triumphs."--San Antonio Express-News

December 2, 2025 Quick space links

Courtesy of BtB’s stringer Jay. This post is also an open thread. I welcome my readers to post any comments or additional links relating to any space issues, even if unrelated to the links below.

- Great photo of 3I/ATLAS taken by astronomers using a Texas ground-based telescope

The image is one of the best of the comet’s tail. As noted at the link, “Comet 3I/ATLAS appears relatively normal when compared to Solar System comets, therefore providing more evidence that our Solar System is a somewhat typical star system.”

- New rumors circulating today suggest that the Zhuque-3 launch could be back on for December 3

According to Jay, the airspace closures have been updated to reflect this date, but nothing as yet been confirmed by China. My guess is that the new bosses now supervising China’s pseudo-rocket companies first demanded a delay so they could “review” things, and were quickly made to realize a long delay made no sense.

- China touts the ongoing construction of a new antenna to be used in its own Deep Space Network for communicating with interplanetary missions

This antenna appears essential especially for its Chang’e-7 lander to the Moon’s south pole, targeting a launch next year.

- On this day in 2018 InSight’s air pressure sensor and seismometer captured the vibrations from the Martian wind

The press release claimed we were hearing the wind of Mars, but that’s bunk. The sounds recorded were from vibrations on the solar panels from that wind.

Courtesy of BtB’s stringer Jay. This post is also an open thread. I welcome my readers to post any comments or additional links relating to any space issues, even if unrelated to the links below.

- Great photo of 3I/ATLAS taken by astronomers using a Texas ground-based telescope

The image is one of the best of the comet’s tail. As noted at the link, “Comet 3I/ATLAS appears relatively normal when compared to Solar System comets, therefore providing more evidence that our Solar System is a somewhat typical star system.”

- New rumors circulating today suggest that the Zhuque-3 launch could be back on for December 3

According to Jay, the airspace closures have been updated to reflect this date, but nothing as yet been confirmed by China. My guess is that the new bosses now supervising China’s pseudo-rocket companies first demanded a delay so they could “review” things, and were quickly made to realize a long delay made no sense.

- China touts the ongoing construction of a new antenna to be used in its own Deep Space Network for communicating with interplanetary missions

This antenna appears essential especially for its Chang’e-7 lander to the Moon’s south pole, targeting a launch next year.

- On this day in 2018 InSight’s air pressure sensor and seismometer captured the vibrations from the Martian wind

The press release claimed we were hearing the wind of Mars, but that’s bunk. The sounds recorded were from vibrations on the solar panels from that wind.

Astronomers detect another galaxy that shouldn’t be there, so soon after the Big Bang

Using the Webb Space Telescopes astronomers have detected another galaxy that shouldn’t be there, so soon after the Big Bang.

The image to the right comes from figure 1 of the peer-reviewed paper. The galaxy’s two spiral arms form a backward “S” emanating out from the galaxy’s nucleus. From the press release:

Using JWST, researchers Rashi Jain and Yogesh Wadadekar spotted a galaxy remarkably similar to our own Milky Way. Yet this system formed when the cosmos was barely 1.5 billion years old—roughly a tenth of its present age. They named it Alaknanda, after the Himalayan river that is a twin headstream of the Ganga alongside the Mandakini—fittingly, the Hindi name for the Milky Way.

…It already has two sweeping spiral arms wrapped around a bright, rounded central region (the galaxy’s ‘bulge’), spanning about 30,000 light-years across. Even more impressively, it is annually churning out new stars, their combined mass roughly equivalent to 60 times the mass of our Sun. This rate is about 20 times that of the present-day Milky Way! About half of Alaknanda’s stars appear to have formed in only 200 million years—a blink in cosmic time.

This galaxy underlines the difficulty for cosmologists by much of Webb’s data of the early universe. Present theories of galaxy formation say it should take billions of years to form such a spiral galaxy, meaning it shouldn’t exist as yet so soon, only 1.5 billion years after the Big Bang.

Either the theories have to be revised substantially, or they are simply wrong entirely. Or we are missing or lacking in some fundamental information about the early universe that skews all our theories.

Using the Webb Space Telescopes astronomers have detected another galaxy that shouldn’t be there, so soon after the Big Bang.

The image to the right comes from figure 1 of the peer-reviewed paper. The galaxy’s two spiral arms form a backward “S” emanating out from the galaxy’s nucleus. From the press release:

Using JWST, researchers Rashi Jain and Yogesh Wadadekar spotted a galaxy remarkably similar to our own Milky Way. Yet this system formed when the cosmos was barely 1.5 billion years old—roughly a tenth of its present age. They named it Alaknanda, after the Himalayan river that is a twin headstream of the Ganga alongside the Mandakini—fittingly, the Hindi name for the Milky Way.

…It already has two sweeping spiral arms wrapped around a bright, rounded central region (the galaxy’s ‘bulge’), spanning about 30,000 light-years across. Even more impressively, it is annually churning out new stars, their combined mass roughly equivalent to 60 times the mass of our Sun. This rate is about 20 times that of the present-day Milky Way! About half of Alaknanda’s stars appear to have formed in only 200 million years—a blink in cosmic time.

This galaxy underlines the difficulty for cosmologists by much of Webb’s data of the early universe. Present theories of galaxy formation say it should take billions of years to form such a spiral galaxy, meaning it shouldn’t exist as yet so soon, only 1.5 billion years after the Big Bang.

Either the theories have to be revised substantially, or they are simply wrong entirely. Or we are missing or lacking in some fundamental information about the early universe that skews all our theories.

Now available in hardback and paperback as well as ebook!

From the press release: In this ground-breaking new history of early America, historian Robert Zimmerman not only exposes the lie behind The New York Times 1619 Project that falsely claims slavery is central to the history of the United States, he also provides profound lessons about the nature of human societies, lessons important for Americans today as well as for all future settlers on Mars and elsewhere in space.

Conscious Choice: The origins of slavery in America and why it matters today and for our future in outer space, is a riveting page-turning story that documents how slavery slowly became pervasive in the southern British colonies of North America, colonies founded by a people and culture that not only did not allow slavery but in every way were hostile to the practice.

Conscious Choice does more however. In telling the tragic history of the Virginia colony and the rise of slavery there, Zimmerman lays out the proper path for creating healthy societies in places like the Moon and Mars.

“Zimmerman’s ground-breaking history provides every future generation the basic framework for establishing new societies on other worlds. We would be wise to heed what he says.” —Robert Zubrin, founder of the Mars Society.

All editions are available at Amazon, Barnes & Noble, and all book vendors, with the ebook priced at $5.99 before discount. All editions can also be purchased direct from the ebook publisher, ebookit, in which case you don't support the big tech companies and the author gets a bigger cut much sooner.

Autographed printed copies are also available at discount directly from the author (hardback $29.95; paperback $14.95; Shipping cost for either: $6.00). Just send an email to zimmerman @ nasw dot org.

Blue Origin faces opposition renewing its permit to dump waste water at Florida launch facility

Chicken Little strikes again!

It appears several local politicians as well as the typical anti-everything activists are expressing opposition to Blue Origin’s request to renew its permit to dump waste water at its Florida launch facility.

Some county commissioners have concerns about the proposal because of how much money and effort has gone to cleaning up the Indian River. “That’s really troubling to me especially when we are spending so much money as a community on the half-cent sales tax and the save the Indian River Lagoon tax,” said Brevard County Commissioner Katie Delaney.

Space experts say large-scale companies don’t necessarily follow rules and regulations put on them. “There has been all sorts of industrial waste issues associated with the aerospace industry not just here in Florida but all across the country,” Florida Tech space professor, Don Platt, said.

The water is likely that used during launches to dampen the shock produced by the rocket’s engines, and like SpaceX’s systems, is almost certainly potable and harmless. This is also a permit that Blue Origin obtained five years ago and has used without harm during all its launchpad tests and launches.

None of this whining really matters, as it appears the county commission has no authority over the matter. The permit was issued by the state’s environmental department which will almost certainly approve the renewal. It is just unfortunate that these whiners almost always get positive coverage from our propaganda press. In this case the local Fox affiliate that reported the story clearly made no effort to research anything. It just simply spouted back the grumbles of these politicians and activists.

Chicken Little strikes again!

It appears several local politicians as well as the typical anti-everything activists are expressing opposition to Blue Origin’s request to renew its permit to dump waste water at its Florida launch facility.

Some county commissioners have concerns about the proposal because of how much money and effort has gone to cleaning up the Indian River. “That’s really troubling to me especially when we are spending so much money as a community on the half-cent sales tax and the save the Indian River Lagoon tax,” said Brevard County Commissioner Katie Delaney.

Space experts say large-scale companies don’t necessarily follow rules and regulations put on them. “There has been all sorts of industrial waste issues associated with the aerospace industry not just here in Florida but all across the country,” Florida Tech space professor, Don Platt, said.

The water is likely that used during launches to dampen the shock produced by the rocket’s engines, and like SpaceX’s systems, is almost certainly potable and harmless. This is also a permit that Blue Origin obtained five years ago and has used without harm during all its launchpad tests and launches.

None of this whining really matters, as it appears the county commission has no authority over the matter. The permit was issued by the state’s environmental department which will almost certainly approve the renewal. It is just unfortunate that these whiners almost always get positive coverage from our propaganda press. In this case the local Fox affiliate that reported the story clearly made no effort to research anything. It just simply spouted back the grumbles of these politicians and activists.

Three new papers find sugars, “gum,” and lots of stardust in the samples brought back from the asteroid Bennu

The asteroid Bennu

Three new papers published this week have found that the samples brought back by OSIRIS-REx from the asteroid Bennu contained some unexpected or unusual materials, including sugars that are important for biology, a gumlike material never seen before, and a much higher amount of stardust than expected.

The papers can be read here, here, and here.

As the press release notes, describing the sugar discovery:

The five-carbon sugar ribose and, for the first time in an extraterrestrial sample, six-carbon glucose were found. Although these sugars are not evidence of life, their detection, along with previous detections of amino acids, nucleobases, and carboxylic acids in Bennu samples, show building blocks of biological molecules were widespread throughout the solar system.

The stardust results found six-times the abundance previously found in other samples.

As for the “gum”, this was possibly the strangest discovery of all, coming from the solar system’s earliest time period.

» Read more

The asteroid Bennu

Three new papers published this week have found that the samples brought back by OSIRIS-REx from the asteroid Bennu contained some unexpected or unusual materials, including sugars that are important for biology, a gumlike material never seen before, and a much higher amount of stardust than expected.

The papers can be read here, here, and here.

As the press release notes, describing the sugar discovery:

The five-carbon sugar ribose and, for the first time in an extraterrestrial sample, six-carbon glucose were found. Although these sugars are not evidence of life, their detection, along with previous detections of amino acids, nucleobases, and carboxylic acids in Bennu samples, show building blocks of biological molecules were widespread throughout the solar system.

The stardust results found six-times the abundance previously found in other samples.

As for the “gum”, this was possibly the strangest discovery of all, coming from the solar system’s earliest time period.

» Read more

Leaving Earth: Space Stations, Rival Superpowers, and the Quest for Interplanetary Travel, can be purchased as an ebook everywhere for only $3.99 (before discount) at amazon, Barnes & Noble, all ebook vendors, or direct from my ebook publisher, ebookit.

If you buy it from ebookit you don't support the big oppressive tech companies and I get a bigger cut much sooner.

Winner of the 2003 Eugene M. Emme Award of the American Astronautical Society.

"Leaving Earth is one of the best and certainly the most comprehensive summary of our drive into space that I have ever read. It will be invaluable to future scholars because it will tell them how the next chapter of human history opened." -- Arthur C. Clarke

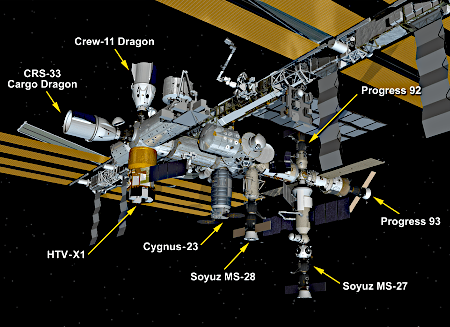

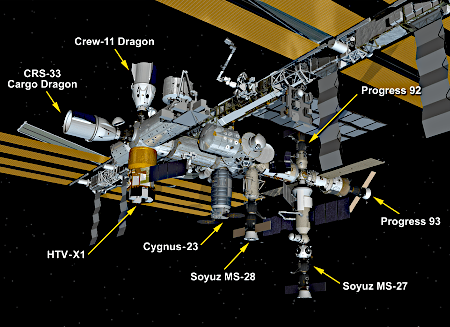

All eight ports on ISS occupied for the first time; Longest manned mission about to start?

ISS as presently configured. Click for original.

For the first time in its more than quarter century history, all eight docking ports on ISS are occupied, as shown in the graphic to the right.

For the first time in International Space Station history, all eight docking ports aboard the orbital outpost are occupied following the reinstallation of Northrop Grumman’s Cygnus XL cargo spacecraft to the Earth-facing port of the station’s Unity module. The eight spacecraft attached to the complex are: two SpaceX Dragons, Cygnus XL, JAXA’s (Japan Aerospace Exploration Agency) HTV-X1, two Roscosmos Soyuz crew spacecraft, and two Progress cargo ships.

This milestone follows the reattachment of the Cygnus XL spacecraft, supporting the Northrop Grumman-23 commercial resupply services mission for NASA, which was removed last week by the robotics officer at the agency’s Mission Control Center in Houston using the space station’s Canadarm2 robotic arm. The Cygnus XL movement was coordinated between NASA, Northrop Grumman, and Roscosmos to provide appropriate clearance for the arriving crewed Soyuz MS-28 spacecraft on Nov. 27.

Cygnus will remain attached to the orbiting laboratory until no earlier than March 2026, when it is scheduled to safely depart and dispose of up to 11,000 pounds of trash and unneeded cargo when it harmlessly burns up in Earth’s atmosphere.

This situation will not last of course, and in fact it may never happen again before the station is retired around 2030. First, Cygnus will leave in March. Second, one Russian Soyuz capsule will leave shortly, as the presence of two simply indicates a crew rotation is underway.

Third, it is presently unclear when the Russians will be able to launch further Soyuz or Progress capsules. » Read more

ISS as presently configured. Click for original.

For the first time in its more than quarter century history, all eight docking ports on ISS are occupied, as shown in the graphic to the right.

For the first time in International Space Station history, all eight docking ports aboard the orbital outpost are occupied following the reinstallation of Northrop Grumman’s Cygnus XL cargo spacecraft to the Earth-facing port of the station’s Unity module. The eight spacecraft attached to the complex are: two SpaceX Dragons, Cygnus XL, JAXA’s (Japan Aerospace Exploration Agency) HTV-X1, two Roscosmos Soyuz crew spacecraft, and two Progress cargo ships.

This milestone follows the reattachment of the Cygnus XL spacecraft, supporting the Northrop Grumman-23 commercial resupply services mission for NASA, which was removed last week by the robotics officer at the agency’s Mission Control Center in Houston using the space station’s Canadarm2 robotic arm. The Cygnus XL movement was coordinated between NASA, Northrop Grumman, and Roscosmos to provide appropriate clearance for the arriving crewed Soyuz MS-28 spacecraft on Nov. 27.

Cygnus will remain attached to the orbiting laboratory until no earlier than March 2026, when it is scheduled to safely depart and dispose of up to 11,000 pounds of trash and unneeded cargo when it harmlessly burns up in Earth’s atmosphere.

This situation will not last of course, and in fact it may never happen again before the station is retired around 2030. First, Cygnus will leave in March. Second, one Russian Soyuz capsule will leave shortly, as the presence of two simply indicates a crew rotation is underway.

Third, it is presently unclear when the Russians will be able to launch further Soyuz or Progress capsules. » Read more

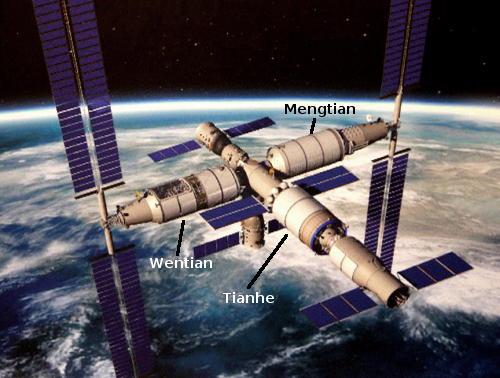

China reveals its plans for the damaged Shenzhou-20 capsule docked to Tiangong-3

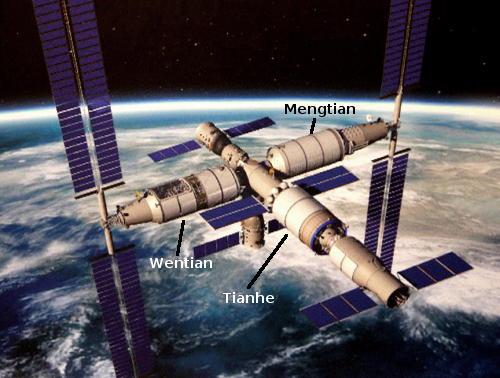

The Tiangong-3 station, as presently configured,

with two Shenzou capsules docked at either end.

Having successfully docked Shenzhou-22 as a lifeboat to its Tiangong-3 space station last week, China’s state-run press yesterday outlined its plans for the damaged Shenzhou-20 capsule that is still docked to the station but cannot be used by its crew because of cracks in one viewport.

First, China’s space operations have decided to attempt a return of the capsule back to Earth, unmanned, so the damage can be inspected in greater detail. Before that happens however the astronauts on board the station will do their own inspection, including the possibility of adding a patch.

During a subsequent spacewalk, the Shenzhou-21 crew, who are now undertaking a six-month orbital stay, may be tasked with inspecting the cracked viewport. They may also perform protective work on it using specialized devices delivered by the Shenzhou-22 launch — a procedure still being validated in ground tests, said Ji in a recent CCTV interview.

A day prior to their planned return on Nov. 5, the Shenzhou-20 crew spotted an anomaly on the viewport’s edge — a triangular, paint-like mark. They photographed it from multiple angles and under different lights, while the station’s robotic arm cameras were employed to take supplemental external pictures.

The flaw was later identified as “penetrating cracks,” said Jia Shijin, chief designer of the crewed spaceship system from China Academy of Space Technology. “The space debris responsible is preliminarily judged to be less than a millimeter in size, but struck with extremely high speed.”

This description of the damage is the most detailed China as yet revealed. These details certainly fit the description of an impact from an outside source, though considering China’s general lack of transparency some skepticism should still be retained. For example, we still do not know if these “penetrating cracks” mean the capsule is no longer holding its atmosphere, or if the crew has closed the capsule’s hatch to keep the air loss to a minimum.

Either way, it appears China’s engineers are concerned that this damage could cause a major break-up of the capsule during re-entry, and are thus considering options for covering it during that return.

The Tiangong-3 station, as presently configured,

with two Shenzou capsules docked at either end.

Having successfully docked Shenzhou-22 as a lifeboat to its Tiangong-3 space station last week, China’s state-run press yesterday outlined its plans for the damaged Shenzhou-20 capsule that is still docked to the station but cannot be used by its crew because of cracks in one viewport.

First, China’s space operations have decided to attempt a return of the capsule back to Earth, unmanned, so the damage can be inspected in greater detail. Before that happens however the astronauts on board the station will do their own inspection, including the possibility of adding a patch.

During a subsequent spacewalk, the Shenzhou-21 crew, who are now undertaking a six-month orbital stay, may be tasked with inspecting the cracked viewport. They may also perform protective work on it using specialized devices delivered by the Shenzhou-22 launch — a procedure still being validated in ground tests, said Ji in a recent CCTV interview.

A day prior to their planned return on Nov. 5, the Shenzhou-20 crew spotted an anomaly on the viewport’s edge — a triangular, paint-like mark. They photographed it from multiple angles and under different lights, while the station’s robotic arm cameras were employed to take supplemental external pictures.

The flaw was later identified as “penetrating cracks,” said Jia Shijin, chief designer of the crewed spaceship system from China Academy of Space Technology. “The space debris responsible is preliminarily judged to be less than a millimeter in size, but struck with extremely high speed.”

This description of the damage is the most detailed China as yet revealed. These details certainly fit the description of an impact from an outside source, though considering China’s general lack of transparency some skepticism should still be retained. For example, we still do not know if these “penetrating cracks” mean the capsule is no longer holding its atmosphere, or if the crew has closed the capsule’s hatch to keep the air loss to a minimum.

Either way, it appears China’s engineers are concerned that this damage could cause a major break-up of the capsule during re-entry, and are thus considering options for covering it during that return.

German rocket startup Isar gets launch contract from ESA

The German rocket startup Isar Aerospace yesterday announced it has won a launch contract from the European Space Agency (ESA) to place a satellite carrying a number of experimental payloads into orbit before the end of 2026.

Satellite launch service company Isar Aerospace has signed a contract with the European Space Agency (ESA) to launch the ΣYNDEO-3 mission under the European Union’s In-Orbit Demonstration and In-Orbit Validation Programme (IOD/IOV). The launch will be carried out from Isar Aerospace’s dedicated launch complex at Andøya Space in Norway from Q4 2026.

…Redwire is the prime contractor for the ΣYNDEO-3 mission and will be delivering its Hammerhead spacecraft for a launch onboard Isar Aerospace’s launch vehicle Spectrum to a low Earth orbit (LEO). The spacecraft was built and integrated at Redwire’s state-of-the-art satellite processing facility in Belgium. The spacecraft aggregates 10 innovative payloads from six countries and institutions: Spain, France, Germany, Italy, Luxembourg and the EC.

Isar has yet to reach orbit with its Spectrum rocket. The first launch failed in March only seconds after launch. A second attempt is presently scheduled for sometime prior to December 21, 2025, lifting off from Andoya.

This is the second new launch contract Isar has announced in the past two weeks, and the third since September. At the moment it appears it is gaining momentum pending that first launch later this month, especially because a successful December launch would make it the first European rocket startup to successfully reach orbit.

The German rocket startup Isar Aerospace yesterday announced it has won a launch contract from the European Space Agency (ESA) to place a satellite carrying a number of experimental payloads into orbit before the end of 2026.

Satellite launch service company Isar Aerospace has signed a contract with the European Space Agency (ESA) to launch the ΣYNDEO-3 mission under the European Union’s In-Orbit Demonstration and In-Orbit Validation Programme (IOD/IOV). The launch will be carried out from Isar Aerospace’s dedicated launch complex at Andøya Space in Norway from Q4 2026.

…Redwire is the prime contractor for the ΣYNDEO-3 mission and will be delivering its Hammerhead spacecraft for a launch onboard Isar Aerospace’s launch vehicle Spectrum to a low Earth orbit (LEO). The spacecraft was built and integrated at Redwire’s state-of-the-art satellite processing facility in Belgium. The spacecraft aggregates 10 innovative payloads from six countries and institutions: Spain, France, Germany, Italy, Luxembourg and the EC.

Isar has yet to reach orbit with its Spectrum rocket. The first launch failed in March only seconds after launch. A second attempt is presently scheduled for sometime prior to December 21, 2025, lifting off from Andoya.

This is the second new launch contract Isar has announced in the past two weeks, and the third since September. At the moment it appears it is gaining momentum pending that first launch later this month, especially because a successful December launch would make it the first European rocket startup to successfully reach orbit.

Senate Commerce committee to move up its vote on Isaacman’s nomination as NASA administrator

Billionaire Jared Isaacman

Today Senator Ted Cruz (R-Texas) announced that the Commerce committee he heads will vote on the re-nomination of Jared Isaacman for NASA administration on December 8, 2025, only five days after tomorrow’s renomination hearing.

It appears Cruz and his committee is pushing to get Isaacman approved as quickly as possible. At least one Republican senator, John Cornyn (R-Texas) has met with Isaacman again and gotten his commitment to move the space shuttle Discovery to Texas, as mandated by the budget bill passed several months ago. That commitment was likely a quid pro quo by Cornyn to get his vote for Isaacman.

Once Isaacman is approved by Cruz’s committee, the Senate could vote at any time. Whether it will do so before the end of the year remains unknown, as it would likely require a special session as the Senate is expected to be in recess until after the new year.

If it does not, it will likely give Isaacman very little time to review the next Artemis mission, tentatively schedule for launch as early as February 2026, carrying four astronauts around the Moon on a Orion capsule with a questionable heat shield and an untested environmental system.

Billionaire Jared Isaacman

Today Senator Ted Cruz (R-Texas) announced that the Commerce committee he heads will vote on the re-nomination of Jared Isaacman for NASA administration on December 8, 2025, only five days after tomorrow’s renomination hearing.

It appears Cruz and his committee is pushing to get Isaacman approved as quickly as possible. At least one Republican senator, John Cornyn (R-Texas) has met with Isaacman again and gotten his commitment to move the space shuttle Discovery to Texas, as mandated by the budget bill passed several months ago. That commitment was likely a quid pro quo by Cornyn to get his vote for Isaacman.

Once Isaacman is approved by Cruz’s committee, the Senate could vote at any time. Whether it will do so before the end of the year remains unknown, as it would likely require a special session as the Senate is expected to be in recess until after the new year.

If it does not, it will likely give Isaacman very little time to review the next Artemis mission, tentatively schedule for launch as early as February 2026, carrying four astronauts around the Moon on a Orion capsule with a questionable heat shield and an untested environmental system.

SpaceX gets Air Force approval to launch and land Starship/Superheavy at Cape Canaveral

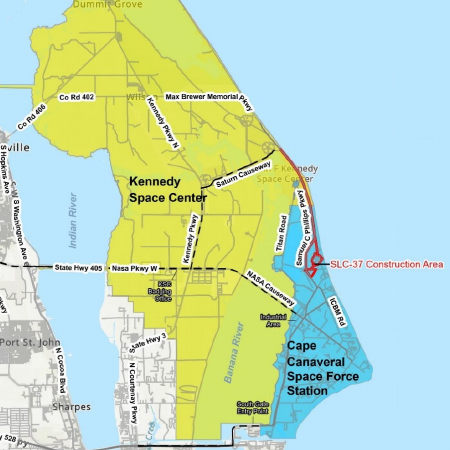

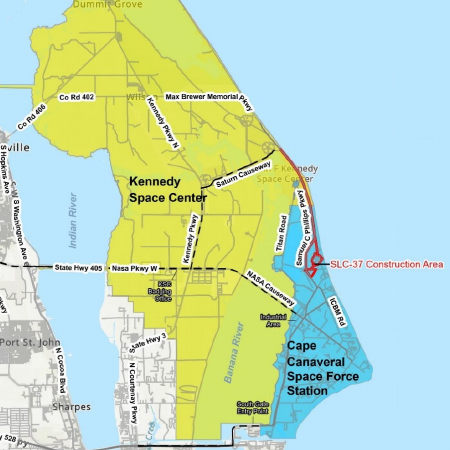

The Air Force announced late yesterday [pdf] that it will now allow SpaceX to launch its Starship/Superheavy rocket at Space Launch Complex 37 (SLC-37) at Cape Canaveral in Florida (as shown on the map to the right) as many as 76 times per year, with twice that number of landings.

The DAF [Department of Air Force] decision authorizes SpaceX to use SLC-37 at CCSFS [Cape Canaveral Space Force Station] to support Starship-Super Heavy launch and landing operations, including the redevelopment of SLC-37 and the other infrastructure improvements required and analyzed in the FEIS [Final Environmental Impact Statement]. Under this ROD [record of decision], upon execution of the real property agreement and associated documentation, and as analyzed in the FEIS while adhering to the mitigation measures specified in Appendix A to this ROD, SpaceX is authorized to: (1) undertake construction activities necessary to re-develop SLC-37 and associated infrastructure for Starship Super Heavy operations; (2) conduct prelaunch operations, including the transportation of launch vehicle components and static fire tests; and (3) conduct up to 76 launches and 152 landings annually once a supplemental analysis of airspace impacts by the Federal Aviation Administration (FAA) is completed. [emphasi mine]

The deal also requires SpaceX to do some road upgrades in order to transport the rocket from its Gigabay to the launch tower. The company immediately announced on X yesterday that it has already begun construction, and expects to have three pads in Florida before all is done.

The final environmental impact statement [pdf] was released on November 20, 2025, and concluded in more than 200 pages that there will be no significant impact from these launch operations, something that should be self-evident after more than three-quarters of century of rocketry at the Cape. The existence of the spaceport acts to protect wildlife, because it limits development across a wide area.

The report suggested that some turtle species and one mouse specie might “affected adversely”, but it it also appears that risk was considered minor and not enough to block development. To deal with this however the impact statement requires SpaceX to do a number of mitigation actions, similar to what it is required to do at Boca Chica.

One fact must be recognized, based on the red tape and delays experienced by SpaceX during the Biden administration. Had Kamala Harris and the cadre that ran the White House under Biden had been in office now, this approval would almost certainly have not happened, or if it did, it would have likely been delayed for a considerable amount of time, into next year at the earliest. It is certain that Trump is clearing the path to prevent red tape and the administrative state from slowing things down unnecessarily.

This announcement also strengthens the likelihood that SpaceX will do at least one launch of Starship/Superheavy from Florida in 2026. And if not then, by 2027 for sure.

The Air Force announced late yesterday [pdf] that it will now allow SpaceX to launch its Starship/Superheavy rocket at Space Launch Complex 37 (SLC-37) at Cape Canaveral in Florida (as shown on the map to the right) as many as 76 times per year, with twice that number of landings.

The DAF [Department of Air Force] decision authorizes SpaceX to use SLC-37 at CCSFS [Cape Canaveral Space Force Station] to support Starship-Super Heavy launch and landing operations, including the redevelopment of SLC-37 and the other infrastructure improvements required and analyzed in the FEIS [Final Environmental Impact Statement]. Under this ROD [record of decision], upon execution of the real property agreement and associated documentation, and as analyzed in the FEIS while adhering to the mitigation measures specified in Appendix A to this ROD, SpaceX is authorized to: (1) undertake construction activities necessary to re-develop SLC-37 and associated infrastructure for Starship Super Heavy operations; (2) conduct prelaunch operations, including the transportation of launch vehicle components and static fire tests; and (3) conduct up to 76 launches and 152 landings annually once a supplemental analysis of airspace impacts by the Federal Aviation Administration (FAA) is completed. [emphasi mine]

The deal also requires SpaceX to do some road upgrades in order to transport the rocket from its Gigabay to the launch tower. The company immediately announced on X yesterday that it has already begun construction, and expects to have three pads in Florida before all is done.

The final environmental impact statement [pdf] was released on November 20, 2025, and concluded in more than 200 pages that there will be no significant impact from these launch operations, something that should be self-evident after more than three-quarters of century of rocketry at the Cape. The existence of the spaceport acts to protect wildlife, because it limits development across a wide area.

The report suggested that some turtle species and one mouse specie might “affected adversely”, but it it also appears that risk was considered minor and not enough to block development. To deal with this however the impact statement requires SpaceX to do a number of mitigation actions, similar to what it is required to do at Boca Chica.

One fact must be recognized, based on the red tape and delays experienced by SpaceX during the Biden administration. Had Kamala Harris and the cadre that ran the White House under Biden had been in office now, this approval would almost certainly have not happened, or if it did, it would have likely been delayed for a considerable amount of time, into next year at the earliest. It is certain that Trump is clearing the path to prevent red tape and the administrative state from slowing things down unnecessarily.

This announcement also strengthens the likelihood that SpaceX will do at least one launch of Starship/Superheavy from Florida in 2026. And if not then, by 2027 for sure.

Two launches today, by Arianespace and SpaceX

Today there were two launches worldwide, one from South America and the second from the U.S.

First, Arianespace launched a South Korea imaging satellite from French Guiana, using the Vega-C rocket built and owned by the Italian rocket company Avio. Based on the July 2024 agreement, this is the next-to-last Vega-C flight that Arianespace will manage. After the next flight, Avio will take over management of its own rocket, cutting out this government middle man, though that agreement also allowed customers who had previously signed with Arianespace for later flights to stay with it as the managing organization.

Either way, Arianespace’s responsibilities will soon be limited solely to the Ariane-6 rocket, which itself has a limited future, being expendable and too expensive to compete in the present launch market.

Next SpaceX launched another 27 Starlink satellites into orbit, its Falcon 9 lifting off from Vandenberg Space Force Base in California. The first stage completed its 20th flight, landing on a drone ship in the Pacific.

As the Vega-C launch was only the sixth for Europe in 2025, it remains off the leader board for the 2025 launch race:

157 SpaceX (a new record)

74 China

15 Rocket Lab

15 Russia

SpaceX now leads the rest of the world in successful launches, 157 to 126.

Today there were two launches worldwide, one from South America and the second from the U.S.

First, Arianespace launched a South Korea imaging satellite from French Guiana, using the Vega-C rocket built and owned by the Italian rocket company Avio. Based on the July 2024 agreement, this is the next-to-last Vega-C flight that Arianespace will manage. After the next flight, Avio will take over management of its own rocket, cutting out this government middle man, though that agreement also allowed customers who had previously signed with Arianespace for later flights to stay with it as the managing organization.

Either way, Arianespace’s responsibilities will soon be limited solely to the Ariane-6 rocket, which itself has a limited future, being expendable and too expensive to compete in the present launch market.

Next SpaceX launched another 27 Starlink satellites into orbit, its Falcon 9 lifting off from Vandenberg Space Force Base in California. The first stage completed its 20th flight, landing on a drone ship in the Pacific.

As the Vega-C launch was only the sixth for Europe in 2025, it remains off the leader board for the 2025 launch race:

157 SpaceX (a new record)

74 China

15 Rocket Lab

15 Russia

SpaceX now leads the rest of the world in successful launches, 157 to 126.

Little Cars – When Sweden Switched To Driving On The Right

December 1, 2025 Quick space links

Courtesy of BtB’s stringer Jay. This post is also an open thread. I welcome my readers to post any comments or additional links relating to any space issues, even if unrelated to the links below.

- Chinese pseudo-company Landspace has apparently postponed indefinitely the first launch of its Zhuque-3 rocket

Jay says Landspace claims “they canceled because of ‘improper paint on the landing pad.'” Neither he nor I believe that tale. I suspect this delay is related to the creation by the Chinese government of a new agency to supervise all of its pseudo-rocket companies. When rumors of that agency appeared in late October, it was speculated that it would delay this launch as the new bosses stepped in a take over.

- The marine platform to recover the first stage of China’s Long March 10 rocket was delivered yesterday

The tweet includes a video claiming that first stage will be captured on this platform using a complex “cable-catching” system that made no sense, as described.

- On this day in 1955 Neil Armstrong completed the first of his seven X-15 flights

He was a most unusual man, at that time a civilian test pilot working for whoever would hire him to test radical airplane designs. The X-15 was then the most radical, only to be superseded soon thereafter by rockets, which Armstrong then transitioned to as a NASA astronaut.

Courtesy of BtB’s stringer Jay. This post is also an open thread. I welcome my readers to post any comments or additional links relating to any space issues, even if unrelated to the links below.

- Chinese pseudo-company Landspace has apparently postponed indefinitely the first launch of its Zhuque-3 rocket

Jay says Landspace claims “they canceled because of ‘improper paint on the landing pad.'” Neither he nor I believe that tale. I suspect this delay is related to the creation by the Chinese government of a new agency to supervise all of its pseudo-rocket companies. When rumors of that agency appeared in late October, it was speculated that it would delay this launch as the new bosses stepped in a take over.

- The marine platform to recover the first stage of China’s Long March 10 rocket was delivered yesterday

The tweet includes a video claiming that first stage will be captured on this platform using a complex “cable-catching” system that made no sense, as described.

- On this day in 1955 Neil Armstrong completed the first of his seven X-15 flights

He was a most unusual man, at that time a civilian test pilot working for whoever would hire him to test radical airplane designs. The X-15 was then the most radical, only to be superseded soon thereafter by rockets, which Armstrong then transitioned to as a NASA astronaut.

Buffalo Bill: The greatest true boy adventure story that’s never been told

In American popular culture, Buffalo Bill is an icon whose history we all think we know, a western showman who in the latter decades of the 19th century traveled the world with his Wild West show, enchanting heads of states as well as ordinary people with the romantic fantasy of the American west, made up of wagon trains, gunfighters, Indian attacks, and last-minute cavalry rescues.

His name inspired the name of a professional football team. His Wild West show inspired at least one musical and numerous Hollywood movies and television shows.

Yet do we really know who the man was?

I discovered recently that we do not. Our culture knows nothing about the man, whose real name was William Cody. Worse, its cartoon vision of him denigrates his unique American nature. He was not only the greatest scout the U.S. Army ever saw, his knowledge of American Indian made it possible for him to not only help make peace with those Indians who wanted it, it also helped the U.S. put down those Indians willing only to wage terrorist war. And when he shifted into the entertainment world, his show provided employment for both his many cowboy friends as well as for many of those same Indians, both friends and former enemies.

And most astonishing of all, I discovered that Buffalo Bill’s childhood was one of the most amazing boy adventure tales, far more exciting than any kid’s movie made in the last hundred years. That Hollywood has never made a movie of his youth now baffles me. It is the stuff that Hollywood craves, but more significantly, it appears it actually happened!

I discovered these facts in reading Don Russell’s wonderful biography of Bill Cody, The Lives and Legends of Buffalo Bill, published by the University of Oklahoma in 1979. Russell’s focus was to dig into the original source material in order to separate the fact from the fiction, since much of Cody’s life had been exaggerated by himself and others during his showman days, and then overblown and warped by Hollywood’s later interpretations.

In this Russell succeeds brilliantly. He describes what we know in vivid language, but also outlines what we don’t know or can’t trust about each story. In the end he describes a unique man with unique talents who always tried to do the right thing, even in difficult circumstances. In every sense Cody’s life was the epitome of an American western pioneer cowboy, pushing the unknown with courage and pluck.

But to me the most amazing part of Russell’s biography was its first few chapters, when Russell describes Cody’s childhood. The boy’s father, Isaac Cody, was a pioneer in his own right, taking his family farther and farther west until they ended up in Kansas and involved in the violent politics there preceding the Civil War. When Isaac died in 1857, he left behind a widow and three young children, who then had to find a way to survive in that difficult pioneer world.

And so, at the age of eleven Billy Cody went out to find work. And the work the boy found was truly astonishing, when compared to what we expect from kids his age today.

» Read more

A detailed look at Europe’s $1 billion commitment to its nascent commercial rocket industry

Link here. In announcing last week the European Space Agency’s (ESA) budget for the next three years, along with its general overall goals, the European council (dubbed CM-25) also apparently committed about $1.45 billion to its “European Launcher Challenge”, a program created in 2023 and designed to encourage the development of new European rockets, owned and operated by independent competing startups.

The article at the link provides a good overall summary of major increase in funding for this program, including which ESA countries are contributing the most and why. The key quote however is this:

In July 2025, ESA shortlisted Isar Aerospace, Rocket Factory Augsburg, PLD Space, MaiaSpace, and Orbex to proceed to the initiative’s next phase. It then began discussions with the host country of each company to assess its willingness to contribute to that company’s participation in the European Launcher Challenge.

During his post-CM25 address, ESA Director General Josef Aschbacher revealed that Member States had committed double the anticipated amount for the European Launcher Challenge, with the final figure exceeding €900 million. While the funding model’s structure suggests that only the UK, Spain, France, and Germany contributed, post-CM25 disclosures have indicated that a few additional countries also committed funds to the programme.

Germany appears to be the biggest contributor, supplying more than a third of the total fund ($422 million). This isn’t surprising, since Germany also has the most rocket startups, three, two of which are on that shortlist (Rocket Factory and Isar). Spain is next with a contribution of $196 million, aimed helping the rocket startup PLD. The UK is next, also contributing $196 million, likely to be used to support its Orbex startup that wants to launch from its Saxavord spaceport in the Shetland Islands.

A variety of other ESA nations, the Czech Republic, the Netherlands, and Norway, have also outlined their contributions, for a variety of space-related startups unrelated to rockets.

France also appears to have donated a significant amount, but has not made that number public. Its MaiaSpace startup is one on that shortlist above, but France also has one or two other rocket startups that might eventually qualify for aid.

The bottom line is that ESA here is committing funding to aid the development of rockets and space infrastructure that it won’t own or control, a major shift from its past policy of owning and controlling everything through its Arianespace pseudo-commercial company, what I call the Soviet- or government-run model. Instead, these ESA nations are going to help fund a range of competing private rockets, which will own the rockets and operate them for profit. ESA will simply become one of their customers, following the capitalism model that the U.S. switched to in the previous decade.

This increased commitment to capitalism in the ESA suggests that we should see some real progress by these startups in the next three years.

If you think the launch records being set this year are breath-taking, you ain’t seen nothin’ yet.

Link here. In announcing last week the European Space Agency’s (ESA) budget for the next three years, along with its general overall goals, the European council (dubbed CM-25) also apparently committed about $1.45 billion to its “European Launcher Challenge”, a program created in 2023 and designed to encourage the development of new European rockets, owned and operated by independent competing startups.

The article at the link provides a good overall summary of major increase in funding for this program, including which ESA countries are contributing the most and why. The key quote however is this:

In July 2025, ESA shortlisted Isar Aerospace, Rocket Factory Augsburg, PLD Space, MaiaSpace, and Orbex to proceed to the initiative’s next phase. It then began discussions with the host country of each company to assess its willingness to contribute to that company’s participation in the European Launcher Challenge.

During his post-CM25 address, ESA Director General Josef Aschbacher revealed that Member States had committed double the anticipated amount for the European Launcher Challenge, with the final figure exceeding €900 million. While the funding model’s structure suggests that only the UK, Spain, France, and Germany contributed, post-CM25 disclosures have indicated that a few additional countries also committed funds to the programme.

Germany appears to be the biggest contributor, supplying more than a third of the total fund ($422 million). This isn’t surprising, since Germany also has the most rocket startups, three, two of which are on that shortlist (Rocket Factory and Isar). Spain is next with a contribution of $196 million, aimed helping the rocket startup PLD. The UK is next, also contributing $196 million, likely to be used to support its Orbex startup that wants to launch from its Saxavord spaceport in the Shetland Islands.

A variety of other ESA nations, the Czech Republic, the Netherlands, and Norway, have also outlined their contributions, for a variety of space-related startups unrelated to rockets.

France also appears to have donated a significant amount, but has not made that number public. Its MaiaSpace startup is one on that shortlist above, but France also has one or two other rocket startups that might eventually qualify for aid.

The bottom line is that ESA here is committing funding to aid the development of rockets and space infrastructure that it won’t own or control, a major shift from its past policy of owning and controlling everything through its Arianespace pseudo-commercial company, what I call the Soviet- or government-run model. Instead, these ESA nations are going to help fund a range of competing private rockets, which will own the rockets and operate them for profit. ESA will simply become one of their customers, following the capitalism model that the U.S. switched to in the previous decade.

This increased commitment to capitalism in the ESA suggests that we should see some real progress by these startups in the next three years.

If you think the launch records being set this year are breath-taking, you ain’t seen nothin’ yet.

After being linked for almost six months, China’s Shijian 21 and Shijian 25 separate

After rendezvousing and doing repeated docking tests in June and July and then remaining linked since then, China’s Shijian 21 and Shijian 25 test satellites have now separated.

Optical ground observations Nov. 29 made by S2a systems, a Swiss company which develops and operates customized systems for optical space surveillance worldwide, reveal that the two satellites have now separated in geosynchronous orbit, close to the geostationary belt (GEO) at 35,786 km above Earth’s equator. The orbits of the pair are inclined by 4.6 degrees with respect to GEO.

The article at the link speculates that the spacecraft were doing refueling tests while docked, but while a good guess this has not been confirmed anywhere. China has said nothing.

Shijian-21 was launched in 2021, and was used to grab a defunct Chinese geosynchronous satellite and tug it to a graveyard orbit. Shijian-25 was launched in January 2025, apparently intended to test robotic servicing of satellites. These maneuvers with Shijian-21 appear to be part of those tests. Whether those tests included refueling is uncertain, though possible. If Shijian-21 proceeds to do additional satellite tug maneuvers then it will strongly suggest this refueling occurred and was successful.

After rendezvousing and doing repeated docking tests in June and July and then remaining linked since then, China’s Shijian 21 and Shijian 25 test satellites have now separated.

Optical ground observations Nov. 29 made by S2a systems, a Swiss company which develops and operates customized systems for optical space surveillance worldwide, reveal that the two satellites have now separated in geosynchronous orbit, close to the geostationary belt (GEO) at 35,786 km above Earth’s equator. The orbits of the pair are inclined by 4.6 degrees with respect to GEO.

The article at the link speculates that the spacecraft were doing refueling tests while docked, but while a good guess this has not been confirmed anywhere. China has said nothing.

Shijian-21 was launched in 2021, and was used to grab a defunct Chinese geosynchronous satellite and tug it to a graveyard orbit. Shijian-25 was launched in January 2025, apparently intended to test robotic servicing of satellites. These maneuvers with Shijian-21 appear to be part of those tests. Whether those tests included refueling is uncertain, though possible. If Shijian-21 proceeds to do additional satellite tug maneuvers then it will strongly suggest this refueling occurred and was successful.

Russia still using black market Starlink terminals on its drones

In its war with the Ukraine, it appears Russia is still managing to obtain black market Starlink mini-terminals for use on its drones, despite an effort since 2024 to block access.

According to Defense Express on November 30, imagery has emerged showing what appears to be a Russian “Molniya”-type drone fitted with a mini-Starlink unit, reportedly observed near the Pokrovsk sector in eastern Ukraine. The configuration—an off-the-shelf satellite internet terminal strapped to a drone—suggests improvised but functional integration, consistent with past sightings. The drone’s design and power unit indicate it is of Russian origin, likely a variation of the Molniya unmanned aerial vehicle, which is known for its low-cost, modular construction.

The use of Starlink terminals on Russian drones was first publicly reported in early 2024. Since then, Ukrainian forces have documented multiple instances of their use, including on Shahed-136 drones and larger UAVs such as the RD-8 “mothership” drone, which is reportedly capable of controlling other loitering munitions using satellite connectivity. The main concern raised by Ukrainian defense observers is that Starlink-based control enables extended-range communications, allowing Russian drones to conduct reconnaissance or strike missions far from ground-based operators.

SpaceX has made no comment on this issue. According to the article, the Ukraine is “exploring alternative European satellite providers in response, seeking more secure and controllable communications infrastructure for military operations.” While switching to another satellite provider might allow the Ukraine to shut Starlink down and prevent the Russians from using it within its territory, doing so would likely do more harm to the Ukraine’s military effort than Russia’s. There isn’t really any other service comparable at this time. And when Amazon’s Leo system comes on line it will face the same black market issues. I doubt it will have any more success than SpaceX in preventing Russia from obtaining its terminals.

Overall this issue is probably not a serious one militarily, however. Russia is not likely capable of obtaining enough black market terminals to make any significant difference on the battlefield.

This story however highlights a positive aspect of these new constellations. Just as Russia can’t be prevented from obtaining black market terminals, neither can the oppressed citizens in totalitarian nations like Russia and China be blocked as well. These constellations as designed act to defeat the censorship and information control of such nations, a very good thing.

In its war with the Ukraine, it appears Russia is still managing to obtain black market Starlink mini-terminals for use on its drones, despite an effort since 2024 to block access.

According to Defense Express on November 30, imagery has emerged showing what appears to be a Russian “Molniya”-type drone fitted with a mini-Starlink unit, reportedly observed near the Pokrovsk sector in eastern Ukraine. The configuration—an off-the-shelf satellite internet terminal strapped to a drone—suggests improvised but functional integration, consistent with past sightings. The drone’s design and power unit indicate it is of Russian origin, likely a variation of the Molniya unmanned aerial vehicle, which is known for its low-cost, modular construction.

The use of Starlink terminals on Russian drones was first publicly reported in early 2024. Since then, Ukrainian forces have documented multiple instances of their use, including on Shahed-136 drones and larger UAVs such as the RD-8 “mothership” drone, which is reportedly capable of controlling other loitering munitions using satellite connectivity. The main concern raised by Ukrainian defense observers is that Starlink-based control enables extended-range communications, allowing Russian drones to conduct reconnaissance or strike missions far from ground-based operators.

SpaceX has made no comment on this issue. According to the article, the Ukraine is “exploring alternative European satellite providers in response, seeking more secure and controllable communications infrastructure for military operations.” While switching to another satellite provider might allow the Ukraine to shut Starlink down and prevent the Russians from using it within its territory, doing so would likely do more harm to the Ukraine’s military effort than Russia’s. There isn’t really any other service comparable at this time. And when Amazon’s Leo system comes on line it will face the same black market issues. I doubt it will have any more success than SpaceX in preventing Russia from obtaining its terminals.

Overall this issue is probably not a serious one militarily, however. Russia is not likely capable of obtaining enough black market terminals to make any significant difference on the battlefield.

This story however highlights a positive aspect of these new constellations. Just as Russia can’t be prevented from obtaining black market terminals, neither can the oppressed citizens in totalitarian nations like Russia and China be blocked as well. These constellations as designed act to defeat the censorship and information control of such nations, a very good thing.

SpaceX launches another 29 Starlink satellites

SpaceX in the early morning hours today successfully launched 29 more Starlink satellites, its Falcon 9 rocket lifting off from the Kennedy Space Center in Florida.

The first stage completed its fourth flight, landing on a drone ship in the Atlantic.

The leaders in the 2025 launch race:

156 SpaceX (a new record)

74 China

15 Rocket Lab

15 Russia

SpaceX now leads the rest of the world in successful launches, 156 to 125.

SpaceX in the early morning hours today successfully launched 29 more Starlink satellites, its Falcon 9 rocket lifting off from the Kennedy Space Center in Florida.

The first stage completed its fourth flight, landing on a drone ship in the Atlantic.

The leaders in the 2025 launch race:

156 SpaceX (a new record)

74 China

15 Rocket Lab

15 Russia

SpaceX now leads the rest of the world in successful launches, 156 to 125.

South Korean rocket startup Innospace announces date for inaugural launch

The South Korean rocket startup Innospace late last week announced that it has delayed the date for the first launch of its Hanbit-Nano rocket a few days in order to correct a “minor anomaly” during testing in Brazil.

During the avionics integration test, INNOSPACE performed a detailed analysis of a minor signal anomaly observed in a specific segment of the test and confirmed the tolerance range of the integration profile affected by flight-environment variations. To further validate the findings, the company carried out a second test using a Brazilian Air Force aircraft under conditions closely replicating the actual flight environment, allowing for a comprehensive review of response characteristics and signal stability across all integration items.

The launch was previously scheduled for a launch window from November 22nd to December 17th, taking place from Brazil’s long unused Alcantara spaceport on its northeast coast. The new window now runs from

December 16th to December 22nd. The launch itself is now scheduled for December 17th.

If this launch is successful, South Korea will have leapfrogged past India, Japan, and Australia to be the first Asian country to have a private company successfully launch a rocket.

The South Korean rocket startup Innospace late last week announced that it has delayed the date for the first launch of its Hanbit-Nano rocket a few days in order to correct a “minor anomaly” during testing in Brazil.

During the avionics integration test, INNOSPACE performed a detailed analysis of a minor signal anomaly observed in a specific segment of the test and confirmed the tolerance range of the integration profile affected by flight-environment variations. To further validate the findings, the company carried out a second test using a Brazilian Air Force aircraft under conditions closely replicating the actual flight environment, allowing for a comprehensive review of response characteristics and signal stability across all integration items.

The launch was previously scheduled for a launch window from November 22nd to December 17th, taking place from Brazil’s long unused Alcantara spaceport on its northeast coast. The new window now runs from

December 16th to December 22nd. The launch itself is now scheduled for December 17th.

If this launch is successful, South Korea will have leapfrogged past India, Japan, and Australia to be the first Asian country to have a private company successfully launch a rocket.

New Australian rocket startup completes suborbital launch

Australian spaceports: operating (red dot) and proposed (red “X”)

Click for original image.

A new Australian rocket startup, AtSpace, announced earlier this week it had successfully launched a test suborbital rocket from the commercial spaceport Southern Launch on the south coast of Australia.

At 09:22 AM [on November 27th], the 12.2m tall vehicle rocketed from Southern Launch’s Koonibba Test Range, performed perfectly and flew close to the target altitude of 80km. The four-and-a-half-minute flight validated AtSpace’s hybrid propulsion technology before safely returning to Earth as planned.

According to the press release, the company was able to recover the rocket afterward.

The company’s website says it was founded in 2021, and plans an orbital rocket dubbed Kestral, using hybrid fuels. No target dates for a first launch however are provided.

AtSpace is Australia’s second rocket startup to launch, following Gilmour Space’s failed launch attempt from its own Bowen spaceport on the east coast of Australia. Gilmour hopes to try again next year.

Australian spaceports: operating (red dot) and proposed (red “X”)

Click for original image.

A new Australian rocket startup, AtSpace, announced earlier this week it had successfully launched a test suborbital rocket from the commercial spaceport Southern Launch on the south coast of Australia.

At 09:22 AM [on November 27th], the 12.2m tall vehicle rocketed from Southern Launch’s Koonibba Test Range, performed perfectly and flew close to the target altitude of 80km. The four-and-a-half-minute flight validated AtSpace’s hybrid propulsion technology before safely returning to Earth as planned.

According to the press release, the company was able to recover the rocket afterward.

The company’s website says it was founded in 2021, and plans an orbital rocket dubbed Kestral, using hybrid fuels. No target dates for a first launch however are provided.

AtSpace is Australia’s second rocket startup to launch, following Gilmour Space’s failed launch attempt from its own Bowen spaceport on the east coast of Australia. Gilmour hopes to try again next year.

China launches classified payload into orbit

China early today successfully placed a classified satellite into orbit, its Long March 7A rocket lifting off from its coastal Wenchang spaceport in southern China.

Video of the launch can be seen here.

China’s state-run press provided no information about the satellite or payload.

China’s communists to its citizens “Nice business you got here.

Shame if something happened to it.”

In related news, that state-run press made official what had been rumored in late October, that the government has now formed a special agency to supervise the pseudo-companies in its faux commercial rocket industry.

In other words, the government has decided the little freedom it gave these pseudo-companies was too much. It is now going to coordinate their efforts from above, and do so much more tightly. I suspect this decision was prompted by the success of some of these companies — taking advantage of that small measure of freedom. The government’s has gotten some new rockets and satellite constellations. Now it can step in and take over, like the mobsters communist governments are.

The leaders in the 2025 launch race:

155 SpaceX

74 China (a new record)

15 Rocket Lab

15 Russia

SpaceX still leads the rest of the world in successful launches, 155 to 125.

China early today successfully placed a classified satellite into orbit, its Long March 7A rocket lifting off from its coastal Wenchang spaceport in southern China.

Video of the launch can be seen here.

China’s state-run press provided no information about the satellite or payload.

China’s communists to its citizens “Nice business you got here.

Shame if something happened to it.”

In related news, that state-run press made official what had been rumored in late October, that the government has now formed a special agency to supervise the pseudo-companies in its faux commercial rocket industry.

In other words, the government has decided the little freedom it gave these pseudo-companies was too much. It is now going to coordinate their efforts from above, and do so much more tightly. I suspect this decision was prompted by the success of some of these companies — taking advantage of that small measure of freedom. The government’s has gotten some new rockets and satellite constellations. Now it can step in and take over, like the mobsters communist governments are.

The leaders in the 2025 launch race:

155 SpaceX

74 China (a new record)

15 Rocket Lab

15 Russia

SpaceX still leads the rest of the world in successful launches, 155 to 125.

Ginger Rogers & Fred Astaire – Swing Time

An evening pause: From the 1936 film of the same name. Fred improvises to save Ginger’s job as a dance teacher. Watch how Rogers’ impression of him and her interaction during the dance evolves so naturally. I have always found her to be not only a great dancer, able to keep up with Astaire (the king of all dance), but also a marvelous actress.

Note too how this is not the gymnastics of modern dance, which is often only one small step above a Jane Fonda exercise video, but an amazingly nuanced and choreographed sequence of complex steps and moves, set to American pop music but with graceful classical ballet in mind.

Hat tip Judd Clark.

SpaceX launches another Transporter mission, including dozens of smallsats

SpaceX today successfully completed its fifteenth Transporter mission of smallsats, its Falcon 9 rocket lifting off from Vandenberg Space Force Base in California.

The two major customers for this mission were Planet Lab, placing 36 satellites for its imagery constellation, and Exolaunch, which acts as a launch manager for smallsat companies. It placed 58 payloads in orbit for many various companies. Another launch manager company, SEOPS, launched 7 payloads, while the European aerospace company OHB launched 8. Among the other payloads was Varda’s fifth re-usable capsule.

The rocket’s two fairings completed their fourth and fifth flights respectively. The first stage (B1071) completed its 30th flight, landing on a drone ship in the Pacific. With this launch this booster become the second SpaceX first stage to achieve at least thirty flights. As the rankings for the most reused launch vehicles below show, SpaceX now has four boosters close to becoming the most reused rockets ever.

39 Discovery space shuttle

33 Atlantis space shuttle

31 Falcon 9 booster B1067

30 Falcon 9 booster B1071

29 Falcon 9 booster B1063

28 Falcon 9 booster B1069

28 Columbia space shuttle

The leaders in the 2025 launch race:

155 SpaceX (a new record)

73 China

15 Rocket Lab

15 Russia

SpaceX now leads the rest of the world in successful launches, 155 to 124.

SpaceX today successfully completed its fifteenth Transporter mission of smallsats, its Falcon 9 rocket lifting off from Vandenberg Space Force Base in California.

The two major customers for this mission were Planet Lab, placing 36 satellites for its imagery constellation, and Exolaunch, which acts as a launch manager for smallsat companies. It placed 58 payloads in orbit for many various companies. Another launch manager company, SEOPS, launched 7 payloads, while the European aerospace company OHB launched 8. Among the other payloads was Varda’s fifth re-usable capsule.

The rocket’s two fairings completed their fourth and fifth flights respectively. The first stage (B1071) completed its 30th flight, landing on a drone ship in the Pacific. With this launch this booster become the second SpaceX first stage to achieve at least thirty flights. As the rankings for the most reused launch vehicles below show, SpaceX now has four boosters close to becoming the most reused rockets ever.

39 Discovery space shuttle

33 Atlantis space shuttle

31 Falcon 9 booster B1067

30 Falcon 9 booster B1071

29 Falcon 9 booster B1063

28 Falcon 9 booster B1069

28 Columbia space shuttle

The leaders in the 2025 launch race:

155 SpaceX (a new record)

73 China

15 Rocket Lab

15 Russia

SpaceX now leads the rest of the world in successful launches, 155 to 124.

ESA’s member nations approve a major budget increase

At the council meeting of the European Space Agency’s (ESA) member nations taking place this week in Bremen, Germany, the council approved a major 32% budget increase for the agency over the next three years.

The largest contributions in the history of the European Space Agency, €22.1 bn, have been approved at its Council meeting at Ministerial level in Bremen, Germany.

Ministers and high-level representatives from the 23 Member States, Associate Members and Cooperating States confirmed support for key science, exploration and technology programmes alongside a significant increase in the budget of space applications – Earth observation, navigation and telecommunications. These three elements are also fundamental to the European Resilience from Space initiative, a joint response to critical space needs in security and resilience.

“This is a great success for Europe, and a really important moment for our autonomy and leadership in science and innovation. I’m grateful for the hard work and careful thought that has gone into the delivery of the new subscriptions from the Member States, amounting to a 32% increase, or 17% increase if corrected for inflation, on ESA’s 2022 Ministerial Council,” said ESA Director General Josef Aschbacher.

How ESA will use this money however remains somewhat unclear, based on a reading of the various resolutions released in connection with this announcement. As is typical for ESA, the language of every document is vague, byzantine, and jargon-filled, making it difficult to determine exactly what it plans to do. Overall it appears the agency will continue most of the various projects it has already started, and do them in the same manner it has always done them, taking years if not decades to bring them to fruition (if ever). It also appears the agency will devote a portion of this money to create new “centers” in Norway and Poland, which as far as I can tell are simply designed to provide pork jobs for those nations and ESA.

The resolutions also placed as the agency’s number one goal not space exploration but “protect[ing] our planet and climate” (see this pdf), a focus that seems off the mark at a very base level. While I could find nothing specifically approving the odious space law that attempted to impose European law globally (and has been vigorously opposed by the U.S.), the language in this document suggests the council still heartily wants to approve that law, and if it doesn’t do so in total it will do so incrementally, bit by bit, in the next few years.

The most hopeful item among these resolutions was the €4.4 billion the council reserved for space transportation, with the money to be used to pay for upgrades to both the Ariane-6 and Vega-C rockets and the facilities in French Guiana, as well as expand ESA’s program encouraging the new rocket startups from Germany, Spain, and France. If ESA uses this money wisely — mostly for the latter item — it will do much to create for itself a competitive launch industry, something it presently does not have.

It will take a bit of time to see how these decisions play out. It remains very unclear at this moment if Europe is choosing the Soviet or the capitalism model for its future in space.

At the council meeting of the European Space Agency’s (ESA) member nations taking place this week in Bremen, Germany, the council approved a major 32% budget increase for the agency over the next three years.

The largest contributions in the history of the European Space Agency, €22.1 bn, have been approved at its Council meeting at Ministerial level in Bremen, Germany.

Ministers and high-level representatives from the 23 Member States, Associate Members and Cooperating States confirmed support for key science, exploration and technology programmes alongside a significant increase in the budget of space applications – Earth observation, navigation and telecommunications. These three elements are also fundamental to the European Resilience from Space initiative, a joint response to critical space needs in security and resilience.

“This is a great success for Europe, and a really important moment for our autonomy and leadership in science and innovation. I’m grateful for the hard work and careful thought that has gone into the delivery of the new subscriptions from the Member States, amounting to a 32% increase, or 17% increase if corrected for inflation, on ESA’s 2022 Ministerial Council,” said ESA Director General Josef Aschbacher.

How ESA will use this money however remains somewhat unclear, based on a reading of the various resolutions released in connection with this announcement. As is typical for ESA, the language of every document is vague, byzantine, and jargon-filled, making it difficult to determine exactly what it plans to do. Overall it appears the agency will continue most of the various projects it has already started, and do them in the same manner it has always done them, taking years if not decades to bring them to fruition (if ever). It also appears the agency will devote a portion of this money to create new “centers” in Norway and Poland, which as far as I can tell are simply designed to provide pork jobs for those nations and ESA.

The resolutions also placed as the agency’s number one goal not space exploration but “protect[ing] our planet and climate” (see this pdf), a focus that seems off the mark at a very base level. While I could find nothing specifically approving the odious space law that attempted to impose European law globally (and has been vigorously opposed by the U.S.), the language in this document suggests the council still heartily wants to approve that law, and if it doesn’t do so in total it will do so incrementally, bit by bit, in the next few years.

The most hopeful item among these resolutions was the €4.4 billion the council reserved for space transportation, with the money to be used to pay for upgrades to both the Ariane-6 and Vega-C rockets and the facilities in French Guiana, as well as expand ESA’s program encouraging the new rocket startups from Germany, Spain, and France. If ESA uses this money wisely — mostly for the latter item — it will do much to create for itself a competitive launch industry, something it presently does not have.

It will take a bit of time to see how these decisions play out. It remains very unclear at this moment if Europe is choosing the Soviet or the capitalism model for its future in space.