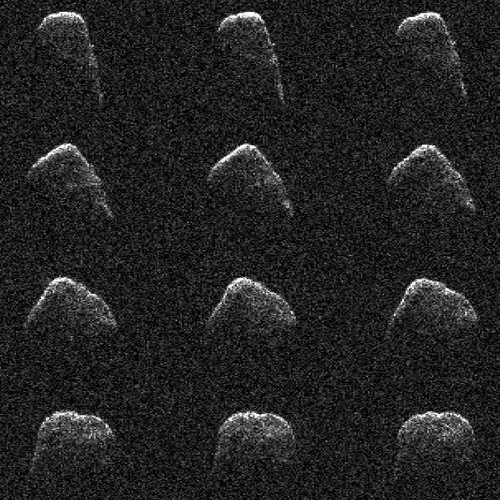

A tumbling 1,100-foot-wide asteroid

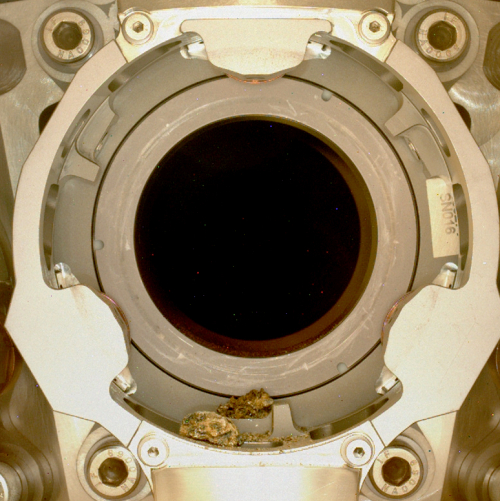

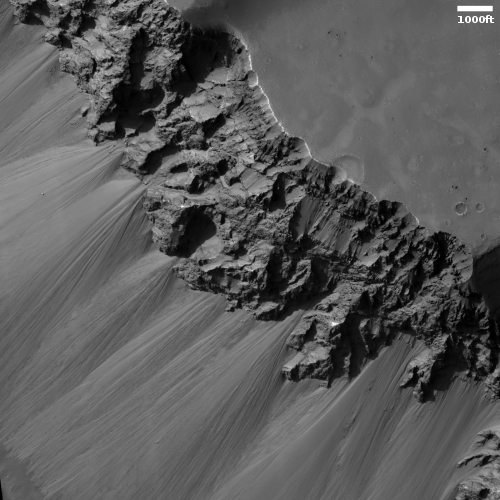

Using the Goldstone radio antenna in California, scientists have been able to take some of the highest resolution radar images of the 1,100-foot-wide asteroid Nereus during its close approach to Earth on December 10, 2021.

The montage to the right, cropped to post here, shows twelve images from the 39-image sequence, which can also be viewed as an animation here.

During the asteroid’s close approach, an image resolution of about 12.3 feet (3.75 meters) per pixel was possible, revealing surface features such as potential boulders and craters, plus ridges and other topography. Asteroid Nereus’ previous approach in 2002 was near enough to Earth to reveal the asteroid’s size and overall shape, but too distant to show surface features. The new observations will also help scientists better understand the asteroid’s shape and rotation while providing them new data to further refine its orbital path around the Sun.

The asteroid will not make a similar close-approach again until 2060.

Using the Goldstone radio antenna in California, scientists have been able to take some of the highest resolution radar images of the 1,100-foot-wide asteroid Nereus during its close approach to Earth on December 10, 2021.

The montage to the right, cropped to post here, shows twelve images from the 39-image sequence, which can also be viewed as an animation here.

During the asteroid’s close approach, an image resolution of about 12.3 feet (3.75 meters) per pixel was possible, revealing surface features such as potential boulders and craters, plus ridges and other topography. Asteroid Nereus’ previous approach in 2002 was near enough to Earth to reveal the asteroid’s size and overall shape, but too distant to show surface features. The new observations will also help scientists better understand the asteroid’s shape and rotation while providing them new data to further refine its orbital path around the Sun.

The asteroid will not make a similar close-approach again until 2060.