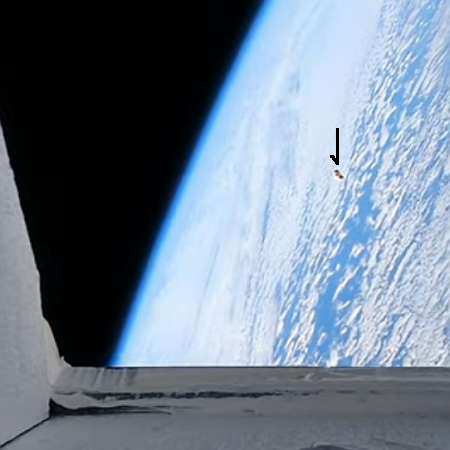

Cargo Dragon undocks from ISS

That this story is not news anymore is really the story. A cargo Dragon capsule that has been docked to ISS since April 22, 2025 today undocked successfully and is scheduled to splashdown off the coast of California on Sunday, May 25, 2025 in the early morning hours.

SpaceX’s Dragon missions to ISS have become so routine that NASA is not even planning to live stream the splashdown, posting updates instead online. This is not actually a surprise, since NASA has practically nothing to do with the splashdown. Once the capsule undocked from ISS, its operation and recovery is entirely in the hands of SpaceX, a private American company.

For NASA, SpaceX is acting as its UPS delivery truck, bringing back to several tons of experiments. And like all UPS delivery trucks, making a delivery is not considered news.

And yet, this is a private commercial spacecraft returning from space, after completing a profitable flight for its owners! That this is now considered so routine that it doesn’t merit much press coverage tells us that the industry of space is beginning to mature into something truly real and sustainable, irrelevant to government.

That this story is not news anymore is really the story. A cargo Dragon capsule that has been docked to ISS since April 22, 2025 today undocked successfully and is scheduled to splashdown off the coast of California on Sunday, May 25, 2025 in the early morning hours.

SpaceX’s Dragon missions to ISS have become so routine that NASA is not even planning to live stream the splashdown, posting updates instead online. This is not actually a surprise, since NASA has practically nothing to do with the splashdown. Once the capsule undocked from ISS, its operation and recovery is entirely in the hands of SpaceX, a private American company.

For NASA, SpaceX is acting as its UPS delivery truck, bringing back to several tons of experiments. And like all UPS delivery trucks, making a delivery is not considered news.

And yet, this is a private commercial spacecraft returning from space, after completing a profitable flight for its owners! That this is now considered so routine that it doesn’t merit much press coverage tells us that the industry of space is beginning to mature into something truly real and sustainable, irrelevant to government.