U.S. budget cuts shifts Blacksky’s satellite imaging business to international customers

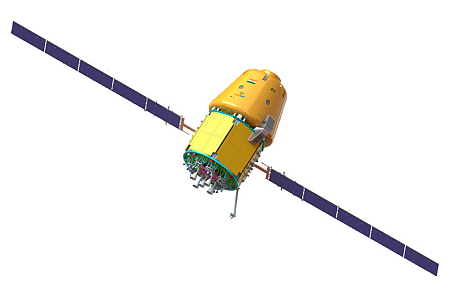

Because of budget cuts by the Trump administration, the revenues of the satellite imaging company Blacksky fell in the third quarter of 2025, but the company expects to make up that loss with new income from international customers.

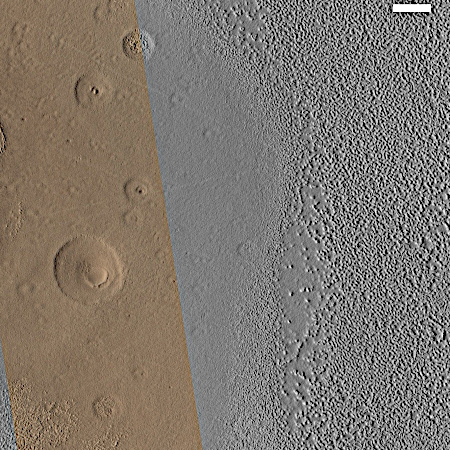

The administration’s fiscal 2026 budget proposal includes a one-third reduction to the National Reconnaissance Office’s commercial imagery procurement, a move that has rippled through companies like BlackSky that rely heavily on government intelligence contracts. The cuts specifically affect the Electro-Optical Commercial Layer (EOCL) program — an NRO initiative to buy satellite imagery from commercial providers.

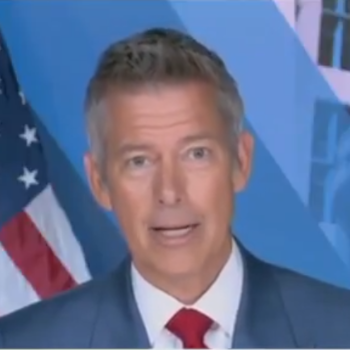

BlackSky reported $19.6 million in third-quarter revenue, missing analyst expectations and down from the previous quarter. Chief Executive Brian O’Toole told analysts the reduction stemmed from adjustments to the company’s EOCL contract “to reflect the potential baseline budget submitted by the administration.”

Sound terrible, eh? Not so fast.

Despite the domestic headwinds, BlackSky is seeing a sharp uptick in overseas business. The company said international sales now account for about half of total revenue, up from 40% a year ago. O’Toole said foreign demand is “outpacing our U.S. government business” and that the company expects international sales to exceed U.S. sales for the first time in 2026.

Blacksky is of course blocked from selling its high resolution reconnaissance imagery to hostile powers, but there are plenty of American allies out there who want this data.

The situation is simple. When American companies are given the freedom to produce, they will create products of value. And the sky won’t fall if the federal government can no longer be their main customer.

Because of budget cuts by the Trump administration, the revenues of the satellite imaging company Blacksky fell in the third quarter of 2025, but the company expects to make up that loss with new income from international customers.

The administration’s fiscal 2026 budget proposal includes a one-third reduction to the National Reconnaissance Office’s commercial imagery procurement, a move that has rippled through companies like BlackSky that rely heavily on government intelligence contracts. The cuts specifically affect the Electro-Optical Commercial Layer (EOCL) program — an NRO initiative to buy satellite imagery from commercial providers.

BlackSky reported $19.6 million in third-quarter revenue, missing analyst expectations and down from the previous quarter. Chief Executive Brian O’Toole told analysts the reduction stemmed from adjustments to the company’s EOCL contract “to reflect the potential baseline budget submitted by the administration.”

Sound terrible, eh? Not so fast.

Despite the domestic headwinds, BlackSky is seeing a sharp uptick in overseas business. The company said international sales now account for about half of total revenue, up from 40% a year ago. O’Toole said foreign demand is “outpacing our U.S. government business” and that the company expects international sales to exceed U.S. sales for the first time in 2026.

Blacksky is of course blocked from selling its high resolution reconnaissance imagery to hostile powers, but there are plenty of American allies out there who want this data.

The situation is simple. When American companies are given the freedom to produce, they will create products of value. And the sky won’t fall if the federal government can no longer be their main customer.