Pushback: Forsyth County school board in Georgia sued for censoring parents during public comment

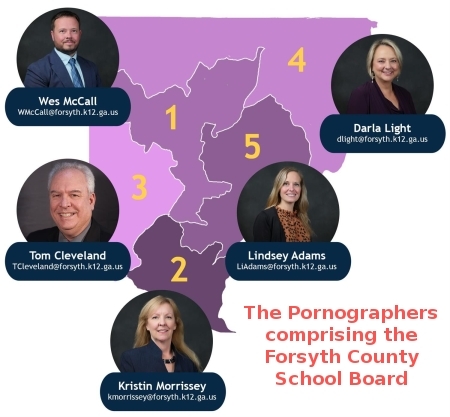

Bring a gun to a knife fight: The five elected members of the Forsyth County Board of Education in Georgia have now been sued for the repeated censoring of parents during their open comment period because the parents wished to read pornographic excerpts from books that school board had approved for use in school libraries.

The suit was filed by the Institute for Free Speech (IFS) for two parents, Alison Hair and Cindy Martin, as well as the independent parents organization called Mama Bears of Forsyth County.

Multiple district residents, including Mama Bears members and plaintiffs in the lawsuit Alison Hair and Cindy Martin, have used their time to read aloud from school library books they consider pornographic. Yet while these materials are available to kids in school, the Chair has cut off and banned speakers who read from them at Board meetings when he deems the language inappropriate or profane.

This catch-22 robs parents of the ability to confront board members with the very language they themselves consider inappropriate for children, such as graphic descriptions of sex acts. After plaintiff Alison Hair attempted to read one such passage at a March 15 board meeting, she received a letter signed by every member of the Board of Education prohibiting her from participating in any future meetings until she provides a written guarantee that she will abide by the Chair’s directives. The Board, however, cannot require that citizens sacrifice their First Amendment rights as a precondition for participating in meetings, the lawsuit explains. [emphasis mine]

You can read the complaint here [pdf]. The facts of the case are very clear: the board members, led by board chairman Wesley McCall, have been abusing their power to silence any criticism. They are also doing whatever they can to prevent parents from revealing the queer and obscene content contained in school library books that the board members have approved for children, as well as creating rules that make removing these books practically impossible. From the complaint:

» Read more

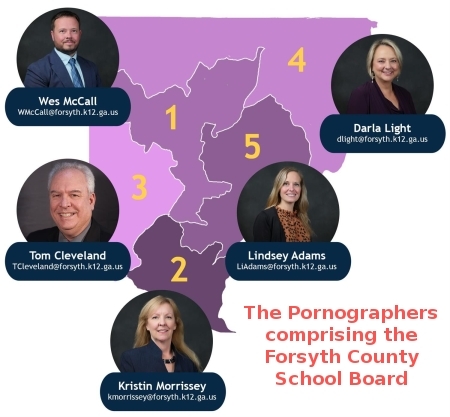

Bring a gun to a knife fight: The five elected members of the Forsyth County Board of Education in Georgia have now been sued for the repeated censoring of parents during their open comment period because the parents wished to read pornographic excerpts from books that school board had approved for use in school libraries.

The suit was filed by the Institute for Free Speech (IFS) for two parents, Alison Hair and Cindy Martin, as well as the independent parents organization called Mama Bears of Forsyth County.

Multiple district residents, including Mama Bears members and plaintiffs in the lawsuit Alison Hair and Cindy Martin, have used their time to read aloud from school library books they consider pornographic. Yet while these materials are available to kids in school, the Chair has cut off and banned speakers who read from them at Board meetings when he deems the language inappropriate or profane.

This catch-22 robs parents of the ability to confront board members with the very language they themselves consider inappropriate for children, such as graphic descriptions of sex acts. After plaintiff Alison Hair attempted to read one such passage at a March 15 board meeting, she received a letter signed by every member of the Board of Education prohibiting her from participating in any future meetings until she provides a written guarantee that she will abide by the Chair’s directives. The Board, however, cannot require that citizens sacrifice their First Amendment rights as a precondition for participating in meetings, the lawsuit explains. [emphasis mine]

You can read the complaint here [pdf]. The facts of the case are very clear: the board members, led by board chairman Wesley McCall, have been abusing their power to silence any criticism. They are also doing whatever they can to prevent parents from revealing the queer and obscene content contained in school library books that the board members have approved for children, as well as creating rules that make removing these books practically impossible. From the complaint:

» Read more